Your 20s are a pivotal period in your life when you have the opportunity to set the stage for a secure financial future. In South Africa, where economic challenges persist, managing your finances wisely is crucial. This blog post will explore 10 actionable steps that South African consumers can take to improve their financial wellbeing during their 20s. Before we dive right in, let’s understand a couple of financial wellbeing concepts.

What is financial health?

Financial health refers to the overall well-being and stability of an individual’s or a household’s financial situation. It encompasses various aspects, including one’s ability to meet financial obligations, save and invest for the future, manage debt responsibly, and maintain a sustainable budget. A financially healthy person typically has emergency savings, minimal high-interest debt, a well-structured budget, and a plan for long-term financial goals like retirement or homeownership. Achieving and maintaining financial health enables individuals to weather unexpected financial challenges, pursue their aspirations, and enjoy peace of mind about their financial future.

What is a credit score?

In South Africa, the credit scoring system is managed by credit bureaus, with the most prominent ones being TransUnion, Experian, and Compuscan. The credit scoring system in South Africa typically uses a scale that ranges from 0 to 999. However, it’s important to note that the exact scoring model and range may vary slightly between different credit bureaus.

Credit scores in South Africa serve a similar purpose as they do in other countries, providing lenders with a snapshot of an individual’s creditworthiness. Factors that influence your credit score in South Africa include your payment history, the amount of debt you owe, the length of your credit history, types of credit used, and any recent credit inquiries. A higher credit score in South Africa indicates better creditworthiness and can lead to more favorable terms on loans, credit cards, and other financial transactions. It’s essential to maintain a healthy credit score to access credit and financial opportunities in the country. If you want to know how to get a free credit report in South Africa, we’ve got you covered in this guide.

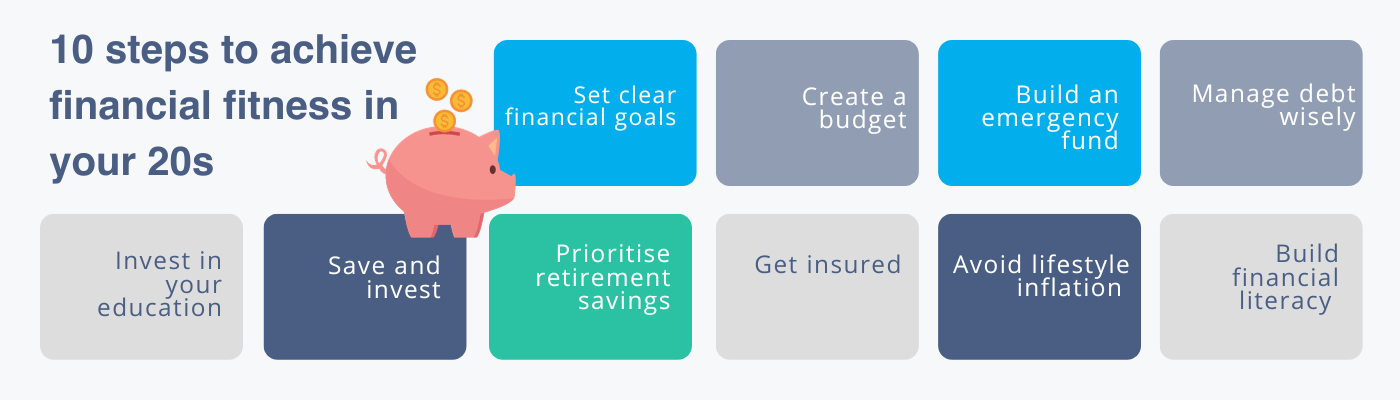

10 steps to achieving financial fitness in your 20s

1. Set clear financial goals ASAP

People in their 20s generally take too long before they set out clear financial goals for their future, your 20s are the best time to be saving so that in your 30s and 40s you can buy the things you want and need. Identify your short-term and long-term financial objectives. Whether it’s saving for a down payment on a house, starting a business, or funding your education, having well-defined goals will provide the direction and motivation needed to make informed financial decisions.

2. Create and stick to a budget

Now this is a hard one, especially when you feel like you have no responsibilities and you can just spend every cent that hits your bank account. Creating a budget is the foundation of sound financial management. Begin by tracking your income and expenses meticulously. Categorise your expenses into fixed (rent, bills) and variable (entertainment, UberEats) costs. A budget helps you allocate your income effectively and ensures you live within your means.

3. Build an emergency fund

Whether you’re in your 20s, 30s or 60s – unexpected events happen and the earlier you are prepared for emergencies the better. Aim to save at least three to six months’ worth of living expenses in a separate savings account. This emergency fund will serve as a financial safety net, enabling you to cover unforeseen costs without resorting to debt.

4. Manage debt wisely

Now that you’ve finally reached an age where you can take out a credit card or qualify for a personal loan – debt can very easily spin out of control. Debt is one of the biggest obstacles to reaching financial fitness. Prioritise paying off high-interest debts, such as credit card balances, as quickly as possible. Focus on reducing your debt burden to free up more of your income for saving and investing in your future.

5. Invest in your education

Your 20s are all about hard work, so while you are working hard use your extra cash to invest in your education. Whether it’s a short course or studying a degree, learning new skills means you are investing in your future earning potential. Consider furthering your education or acquiring new skills that can lead to higher-paying job opportunities, setting the stage for long-term financial success.

6. Save and invest

Savings and investments are key to building wealth. Open a savings account and commit to regularly setting aside a portion of your income. Seek out accounts with competitive interest rates to help your money grow. Additionally, explore investment opportunities in assets like stocks, bonds, or real estate. Starting early allows your investments to compound over time. Don’t be afraid to make risky investments too, your 20s are all about taking some risks because you’ll have a enough time to recover if something goes wrong.

7. Prioritise retirement savings

Even in your 20s, it’s crucial to start saving for retirement. South Africa offers various retirement savings options, such as the Tax-Free Savings Account (TFSA) and Retirement Annuity (RA). These accounts offer tax benefits and can help you accumulate a substantial nest egg for your retirement years.

8. Get insured

Life is unpredictable, and unexpected events can disrupt your financial plans. Protect your financial future by securing insurance policies such as health, life, and disability insurance. These policies provide a safety net for you and your loved ones, helping you navigate unforeseen financial challenges.

9. Avoid lifestyle inflation

As your income grows, it’s tempting to upgrade your lifestyle. While occasional treats are fine, be cautious of lifestyle inflation. Continue living below your means, and save or invest the additional income to build wealth faster.

10. Build financial literacy

Financial literacy is the cornerstone of making informed financial decisions. As you get older it’s important to educate yourself about personal finance by reading books, enrolling in online courses, and following reputable financial websites like Fincheck Academy 😉 Understanding concepts like compound interest, investment strategies, and tax implications empowers you to make smarter financial choices.

Achieving financial fitness in your 20s is a vital step toward securing your financial future in South Africa. These 10 actionable steps can help you build a strong financial foundation. Remember that financial fitness is a journey that requires discipline, patience, and continuous learning. Start implementing these steps today, and you’ll be well on your way to achieving your financial goals and enjoying a prosperous future.

Need a credit card to kick off your 20s?

It’s a smart decision to compare credit cards before jumping right in, make sure the credit card fees are little to none or that the benefits far out way the monthly admin fees. Credit cards are a good starting point for building a healthy credit score, that’s if you pay your bills on time. If you want to compare credit cards from different banks, then use Fincheck – we promise it won’t take longer than 2 minutes!