The reality of Janu-worry hits hard for many South Africans, as early December paychecks can make the next payday seem like an eternity away. As you step into a new year, now is the ideal moment to revamp your financial situations. Whether you aim to liberate yourself from the clutches of debt, establish a robust financial safety net, or elevate your credit score, this guide is crafted with your specific needs in mind. To anyone that’s had doubts about their finances, let’s make this year a time to reflect positively on our moola, confidently saying, “Yes, I achieved it.”

How do I know if I need a money makeover?

Consider a financial makeover in the new year if you find yourself uncertain about your financial standing, encountering challenges in meeting financial goals, or consistently experiencing stress related to money matters. Signs that it might be time for a financial overhaul include living beyond your means, struggling with debt repayment, lacking a clear and effective budget, or falling short on saving for emergencies and future goals. Additionally, if you haven’t recently reviewed or updated your financial plan, lack sufficient insurance coverage, or feel unsure about your retirement savings strategy, these could be further indicators that a money makeover is warranted. Seeking guidance from financial advisors or using online resources to reassess and reshape your financial habits can pave the way for improved financial health and well-being in the upcoming year.

What are the 3 most important financial areas to focus on in the new year?

In the new year, it’s essential to focus on key financial areas that can significantly impact your overall financial health. Consider prioritizing:

- Debt Reduction: Tackle high-interest debts to alleviate financial strain.

- Savings: Build or replenish savings, including establishing an emergency fund for unexpected expenses.

- Credit Improvement: Actively work on improving your credit score through responsible credit management, opening up better financial opportunities and lower interest rates.

Let’s unpack these 3 key areas in a bit more detail in our guide.

Are debt consolidation loans the path to financial freedom?

Many South Africans find themselves entangled in the web of various debts, ranging from credit cards to personal loans. If you’re drowning in multiple monthly payments, a debt consolidation loan could be your lifeline. This financial strategy involves taking out a single loan to pay off multiple debts, simplifying your repayment process and potentially reducing your overall interest rates.

How does debt consolidation work?

Debt consolidation works by combining all your existing debts into one manageable loan with a fixed interest rate and a single monthly payment. This not only streamlines your finances but can also result in lower monthly payments, making it easier to stay on top of your financial obligations.

Where can I get a debt consolidation loan?

When considering a debt consolidation loan, it’s crucial to shop around for the best terms and interest rates. Platforms like Fincheck, make it easy to compare debt consolidation loans all in one place, so take the time to take a look at the different loan terms, fees, and interest rates. Fincheck only works with reputable lenders, so at least you don’t have to worry about that. If you’re looking for the 5 best debt consolidation loans in South Africa, we’ve also rounded them up.

The Benefits and Risks of Debt Consolidation

While debt consolidation can offer significant benefits, such as simplified payments and potential interest savings, it’s essential to be aware of the risks. Be cautious not to accumulate new debts after consolidating, and ensure that the terms of the new loan are favourable in the long run.

Why do I need to build an emergency fund?

Life is unpredictable, and unexpected expenses can arise at any moment, especially in South Africa’s turbulent economy. That’s why building an emergency fund is a fundamental step towards achieving financial stability. This fund acts as a safety net, providing a financial cushion in times of crisis and preventing you from falling into debt when faced with unexpected expenses.

Set yourself realistic savings goals

Start by determining a realistic savings goal for your emergency fund. Financial experts recommend saving at least three to six months’ worth of living expenses. Break this goal down into manageable milestones to make the process less daunting.

Create a budget to boost savings

To fund your emergency fund, it’s essential to create a budget that allocates a portion of your income specifically for savings. Identify areas where you can cut back on unnecessary expenses and redirect those funds towards your emergency fund. Consistency is key in building a robust financial safety net.

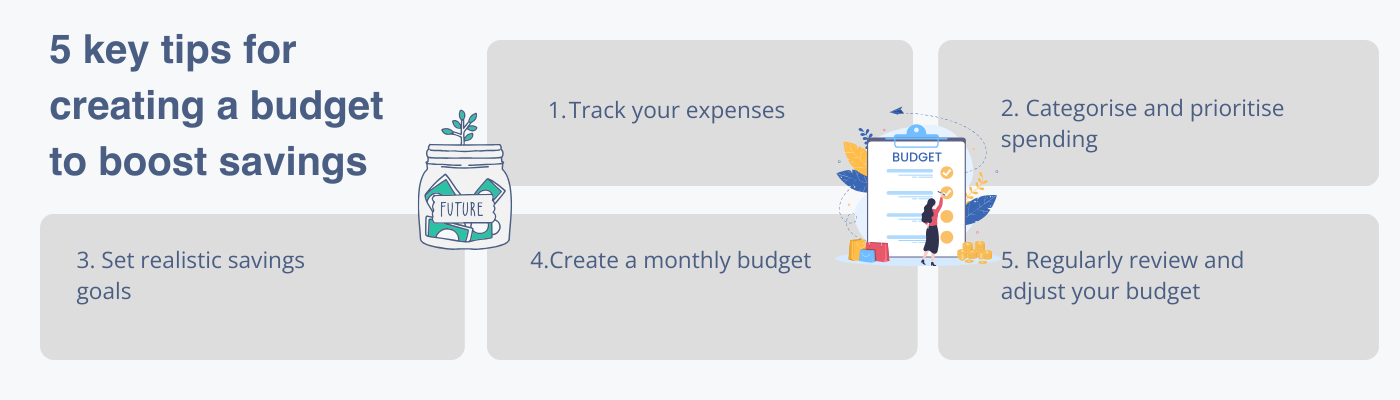

5 key tips for creating a budget to boost savings

- Track your expenses: start by meticulously recording your monthly expenses. This includes fixed costs like rent or mortgage payments, utilities, and insurance, as well as variable expenses such as groceries, dining out, and entertainment. Understanding where your money is going is the first step in creating an effective budget.

- Categorise and prioritise spending: once you’ve tracked your expenses, categorise them into essential and non-essential items. Essential expenses are those necessary for daily living, while non-essentials are discretionary. Prioritise your essential expenses and look for areas where you can cut back on non-essential spending to allocate more funds towards savings.

- Set realistic savings goals: define clear and achievable savings goals. Whether you’re saving for an emergency fund, a vacation, or a major purchase, having specific objectives will motivate you to stick to your budget. Break down larger goals into smaller, manageable milestones to track your progress and celebrate your achievements along the way.

- Create a monthly budget: with a clear understanding of your income, expenses, and savings goals, create a monthly budget. Allocate a specific amount to each expense category, ensuring that your total expenditures do not exceed your income. Be realistic but also challenge yourself to save more by identifying areas where you can reduce unnecessary spending.

- Regularly review and adjust your budget: a budget is not a one-time task; it requires regular review and adjustment. Life circumstances, income, and expenses can change, so it’s essential to revisit your budget periodically. Evaluate your spending patterns, reassess your savings goals, and make necessary adjustments to ensure your budget remains an effective tool for financial success.

Choosing the right savings vehicle

While traditional savings accounts are a popular choice, consider exploring other options that may offer higher interest rates, such as money market accounts or short-term investments. Evaluate the liquidity and accessibility of your chosen savings vehicle to ensure that you can access funds when needed.

Why is checking your credit score the key to financial success?

Your credit score plays a pivotal role in your financial health. A higher credit score not only opens doors to better interest rates on loans but also signifies your creditworthiness to potential lenders. Improving your credit score is a gradual process, but with strategic planning, you can take significant steps in the right direction.

Be sure to check your credit report in the new year

Start by obtaining a copy of your credit report from South Africa’s major credit bureaus. Review the report for any errors, discrepancies, or outstanding debts. Dispute any inaccuracies and address outstanding issues promptly to set the stage for credit score improvement.

Managing your credit utilisation

Credit utilization refers to the ratio of your credit card balances to your credit limits. Aim to keep this ratio below 30% to demonstrate responsible credit management. Paying down existing credit card balances and avoiding maxing out your credit cards can positively impact your credit score.

Why is it important to pay bills on time?

Consistent and timely payment of bills, including credit card payments, is crucial for maintaining a positive credit history. Set up reminders or automatic payments to ensure that you never miss a due date. A history of on-time payments is a significant factor in calculating your credit score.

Embarking on a financial makeover in the New Year is a powerful step towards achieving long-term financial stability. Whether you’re consolidating debts, building an emergency fund, or improving your credit score, the key is to approach each step with commitment and discipline. South African consumers, take charge of your financial future, and let this be the year you turn your financial goals into reality.

Do I need to start thinking about the next years financial goals?

Absolutely! Planning ahead and setting financial goals for the upcoming year is a strategic and proactive approach to personal finance. By contemplating your financial objectives in advance, you gain clarity on your aspirations, whether it’s saving for a down payment, establishing an emergency fund, or paying off debt. This foresight allows you to develop a well-thought-out plan, breaking down larger goals into manageable steps and allocating resources effectively over the course of the year. Thinking about your financial goals now positions you for success, helping you stay focused and disciplined as you work towards achieving your desired financial outcomes in the coming year.