Black Friday has become a global shopping phenomenon, and South Africa is no exception. This day, which traditionally marks the beginning of the holiday shopping season, is eagerly anticipated by consumers looking to snag incredible deals. However, navigating the frenzy of discounts requires a strategic approach to ensure you get the most value for your money. In this comprehensive guide, we’ll delve into the intricacies of Black Friday shopping in South Africa, focusing on spending wisely, leveraging credit cards responsibly, and the importance of careful planning.

What’s the deal with Black Friday?

Black Friday originated in the United States but has evolved into a global shopping event. In South Africa, it gained popularity as retailers started adopting the concept, offering substantial discounts on a wide range of products. The event usually falls on the fourth Friday of November, following the American Thanksgiving holiday.

Who participates in Black Friday in South Africa?

Major retailers in South Africa, both online and brick-and-mortar, participate in Black Friday. From electronics and fashion to household goods, almost every retailer offers some sort of discount.

Here’s a list of popular retailers who take part in Black Friday:

A few other retailers offering Black Friday specials: Norman Goodfellows, Mr Price Home, Food Lover’s Market, OneDayOnly, Hirsch’s.

How can I spend wisely on Black Friday?

1. Set a budget

The allure of massive discounts can be overwhelming, leading to impulse purchases. Combat this by setting a realistic budget before the big day. Consider your financial situation and allocate specific amounts for different categories to avoid overspending.

2. Prioritise needs over wants

Identify your genuine needs before the shopping spree begins. This could be a new laptop for work, a household appliance, or even gifts for upcoming occasions. Focusing on needs rather than wants helps in making more purposeful purchases.

3. Research prices in advance

Retailers may engage in price manipulation, exaggerating original prices to make discounts seem more substantial. Research prices of the items you’re interested in beforehand to ensure you’re getting a genuine bargain.

4. Compare across retailers

Different retailers offer varying discounts on the same products. Don’t settle for the first deal you find; instead, compare prices across multiple stores to maximize savings.

5. Consider quality over quantity

Black Friday can be a temptation to buy more because it’s on sale. Prioritise quality over quantity; it’s better to invest in a durable, high-quality item that meets your needs than to accumulate cheap products that may not last.

What role do credit cards play in Black Friday shopping?

Credit cards play a significant role in Black Friday shopping by providing consumers with a convenient and often preferred method of payment, enabling them to make quick and secure transactions. We’ll discuss the details below.

Choosing the right credit card

If used responsibly, credit cards can be powerful tools during Black Friday sales. Before the event, consider obtaining a credit card with low interest rates and attractive benefits. Many credit cards offer perks like cashback, extended warranties, and purchase protection. It’s best to compare credit card offers well before Black Friday so that you can get approval beforehand. This way you’ll have your hands on a credit card for Black Friday. Fincheck allow you to compare credit card offers in a matter of minutes so that you can get access to the best offers tailored to your needs.

Cashback rewards

Look for credit cards that offer cashback rewards on purchases. This feature allows you to earn a percentage of your spending back, effectively reducing the overall cost of your purchases.

Interest rates and fees

Opt for a credit card with low interest rates to avoid accumulating debt. High-interest rates can quickly negate any savings you make on Black Friday deals. Additionally, be aware of any annual fees associated with the credit card. Being smart about is credit is crucial when Black Friday shopping, Standard Bank outline a few of these smart money tips in their blog post.

Utilise interest-free periods

Some credit cards provide interest-free periods for new purchases. If you plan to make significant Black Friday purchases, using a credit card with an interest-free period allows you to pay off the balance without incurring interest charges.

Set a credit limit

To prevent overspending, set a credit limit that aligns with your budget. This serves as a self-imposed restriction, ensuring you don’t succumb to the allure of excessive shopping.

Black Friday tactics

1. Create a shopping list

Before diving into the Black Friday madness, create a detailed shopping list. This should include specific items you need, their ideal specifications, and the maximum price you’re willing to pay.

2. Prioritise items on your list

If you have a long list of desired items, prioritize them based on urgency and importance. This way, if you don’t manage to snag everything on your list, you still get the most critical items.

3. Be disciplined

Stick to your list religiously. The excitement of Black Friday can lead to impulsive purchases, but a well-thought-out list acts as a guide, helping you stay disciplined in your spending.

4. Check prices before adding to cart

As you shop online, periodically check the prices of items in your cart. Retailers may adjust prices during the course of the day. Ensure you’re getting the best possible deal before finalising your purchase.

5. Navigating online vs in-store Black Friday sales

Online shopping tips:

The convenience of online shopping during Black Friday is unmatched. To make the most of it:

- Use reliable websites: stick to well-known and trusted online retailers to avoid scams.

- Sign up for alerts: subscribe to newsletters or set up notifications for your preferred stores to receive updates on deals.

- Check delivery times: confirm delivery times, especially if you’re purchasing gifts or items needed for specific occasions.

In-store shopping tips:

If you prefer the traditional in-store experience:

- Plan your route: know the locations of the stores you plan to visit and prioritise them based on your shopping list.

- Arrive early: popular items may sell out quickly, so arriving early increases your chances of securing the best deals.

- Be mindful of crowds: large crowds can be overwhelming. Stay focused on your list and be patient in the midst of the chaos.

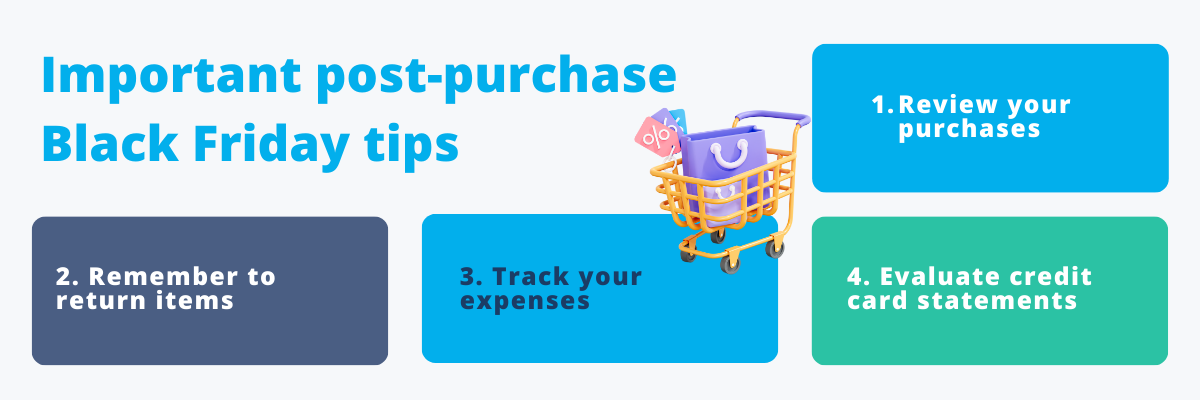

Important post-purchase considerations after Black Friday

1. Review your purchases

After the Black Friday dust settles, take time to review your purchases. Ensure you’ve acquired everything on your list and assess whether each item aligns with your needs.

2. Returns and exchanges

Familiarize yourself with the return and exchange policies of the retailers you purchased from. Knowing the rules beforehand can save you from headaches if a product doesn’t meet your expectations.

3. Track your expenses

Keep a record of your Black Friday expenses. This not only helps you stay within your budget but also provides valuable insights for future shopping endeavours.

4. Evaluate credit card statements

Regularly check your credit card statements to verify the accuracy of charges. Report any discrepancies promptly to ensure your financial records remain accurate.

Bonus tips for smart shopping on Black Friday

In our commitment to helping you navigate the Black Friday shopping extravaganza with wisdom and generosity, we’ve curated three invaluable bonus tips. These tips not only aid you in staying money savvy but also ensure that your emergency savings remain intact.

Tip 1: Be prepared to cut through the clutter

Start by browsing the online shops of your favourite stores well in advance. Create lists with specific categories, links, and prices of the products you deem worthy of purchase.

Doing this will prevent two things: impulsive buying – planning your purchases in advance helps you avoid impulsive decisions on Black Friday, saving you tons of money. Making sure you are actually getting genuine savings on products – by checking prices well before the shopping frenzy, you can be confident that you are genuinely getting a special deal. This proactive approach prevents falling for fake discounts and gimmicks.

Before making any purchase, ask yourself why the product is marked with a special discount and what its actual average retail price is. Some products go on sale to make room for newer versions, while others may have design flaws. There is always another special – resist the urge to succumb to shopping FOMO.

Tip 2: Avoid buyer’s frenzy

The list you create in Tip 1 serves as a powerful form of accountability, preventing you from succumbing to the much-feared buyer’s frenzy. If persevering savings is crucial for you, then maintaining discipline on Black Friday is more important than ever. Remember your emergency funds should be reserved for supporting basic family needs, not depleted by impulsive shopping.

Tip 3: Explore holiday discounts and travel deals

Black Friday isn’t just about retail products; it extends to resorts, travel agencies, and service-oriented businesses. Keep an eye out for holiday coupons and travel deals to make your holiday trips as budget-friendly as possible.

While you may have cancelled your annual holiday trip this year, the right travel deal can offer a weekend of budget-friendly luxury or adventure, uplifting the whole family’s mood.

P.S. Don’t forget about Cyber Monday specials

Black Friday is no longer confined to a single day in South Africa; it’s a month-long shopping extravaganza. Beyond well-known days like Cyber Monday and Black Friday, many retailers run sales throughout November.

With your lists and links prepared from Tip 1, you are set for a month of budget shopping. Take the effort to set up your lists, and you’ll be well-prepared for a November filled with fantastic deals.

Black Friday in South Africa offers an exciting opportunity to secure incredible deals, but the key to a successful and satisfying shopping experience lies in spending wisely. By setting a budget, carefully planning your purchases, and leveraging the benefits of a good credit card, you can make the most of this annual shopping extravaganza. Remember, it’s not just about saving money; it’s about making informed choices that align with your needs and financial goals. With the right mindset and strategy, you can turn Black Friday into a rewarding and value-driven experience.