We are pretty sure there has been a moment in your life where you wanted to be in the next Need for Speed or Too Fast Too Furious movie driving a Ferrari. Well, we’ve got some good news for you, driving your dream car is a possibility (obviously still one within budget), so we’ve decided to put together a step-by-step guide on things to keep in mind when purchasing a car.

Buying a new car can be a very exciting but tedious task with so many options and factors to consider it can become quite difficult to navigate the car buying journey. Driving off in your shiny new wheels should be a fun experience, so let us help you take some of the admin off of your hands so you can make an informed financial decision.

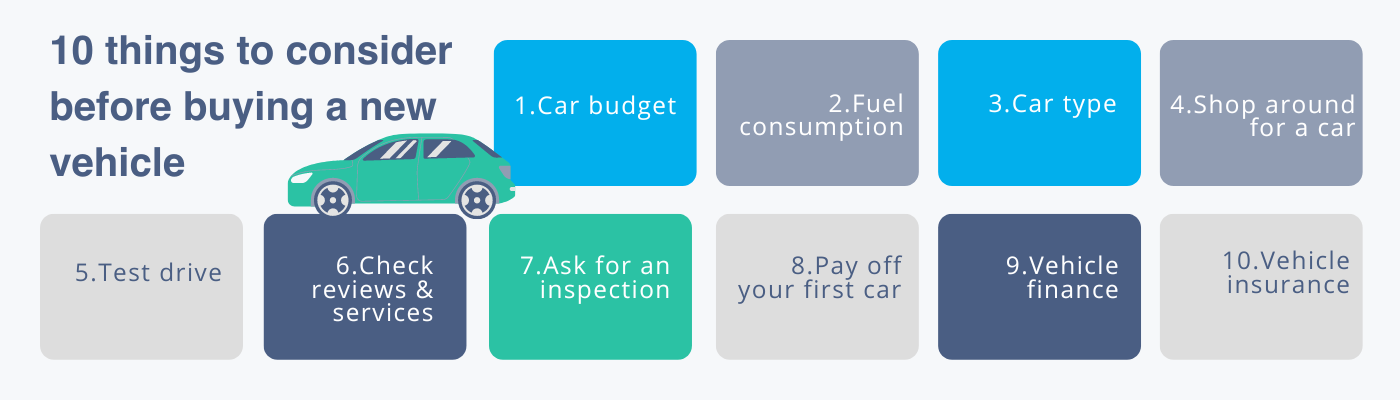

10 things to keep in mind when buying a new car in South Africa

1. Car budget

While we’d all like to be speeding off in the newest Lamborghini, chances are you’ll be looking for a car that is more within your budget. Start off by assessing your overall finances, this includes your monthly income, your expenses and all current loans in your name. Put together a spreadsheet with all of these amounts, once you’ve tallied everything up, you’ll be able to see whether your finances are healthy or not. If you are in a financial position where you can buy a car with cash, that’s great then you have a solid budget to work with. If don’t have the funds right now or would rather spend that money elsewhere, then vehicle finance is a great option to think about (we’ll get to that further on).

2. Fuel consumption

In South Africa, this is probably number one on any vehicle buyers list. With the rise of petrol prices happening on the daily, it’s only smart as a future car owner to be fully aware of the fuel consumption of the car you are looking to buy. So what are your options when it comes to fuel type? In South Africa, the two most readily available fuel types are petrol and diesel. Petrol cars are more common in South Africa but have a higher fuel consumption than Diesel. Diesel fuel prices however are much higher than petrol, but because of the lower fuel consumption, it’s still a lot cheaper to drive. If you are driving short distances, then a Petrol car will do the job, but if you often drive across the country, or use your car for family holidays then a diesel car is probably a better option. Then another option to throw into the mix are electric vehicles, with the option of a full Electric Vehicle (EV) or a hybrid vehicle with an Internal Combustion Engine (ICE). Although these cars are far more expensive to purchase because of the high import tax, they are definitely much cheaper to run per kilometre. In the last 2 years, South Africa has really upped their game when it comes to electric car charging stations, which are now available at most service stations on national highways (N1&N2) and large shopping centres. The fuel type of the car should be high on the list of things to consider, as this along with your budget play a huge part in deciding what car you can afford.

3. Car type

You’ll probably already have a dream car in mind, but it’s important to think about the type of car you are wanting to purchase. What kind of body type, drive type and engine you are looking at? According to Women on Wheels, there are 10 different body types available for sale in South Africa, these are generally: Double cab, Single cab, Super cab, SUV, MPV, Hatchback, Crossover, Sedan, Coupe and Cabriolet. Choosing the body type will be entirely dependent on your needs, if you have a family a sedan or SUV with plenty of seating and boot space might be the best option. If you are a young professional and living in the city then a hatchback might be easiest to manoeuvre around (plus it’s pretty easy to reverse park). Engine types are another thing to consider (and can become quite complicated), explained simply: the more cylinders the car has the more powerful it is, four cylinders are the most common found in modern cars. Engine size is measured by engine capacity, this refers to the total volume of the cylinders in the engine – this is usually expressed in litres (e.g. 1.4l). Essentially the larger the volume of the cylinder the more power the engine carries, however, modern turbocharged engines (more air is able to push through the cylinders) can be just as potent. Then the last part to consider when it comes to car type is the type of drive of the vehicle, in South Africa this is generally: all-wheel-drive (AWD), front wheel drive (FWD), rear wheel drive (RWD), and 4X4 (4 wheel drive).

4. Shop around for a vehicle

As you are well aware purchasing a car is a huge financial decision, and it’s also a decision you need to be happy with for a good chunk of time. Now that you finally have an idea of the type of car you’d like to buy it’s a good idea to shop around to compare prices. Before shopping around you’ll need to decide whether you want to buy a vehicle brand new or if you are looking to buy a second-hand car. If you want to go the route of buying a brand new car, you’ll either need to go to a physical car dealership branch e.g. Volkswagen or BMW – new cars are usually the same price at different branches nationwide (so keep an eye out for nationwide promotions) or you can visit sites like car.co.za ‘New Car’ section. If you are wanting to go the route of buying second hand then companies like cars.co.za and WeBuyCars allow you to compare and filter requirements, plus you’ll be able to compare car prices all over the country. Make a list of the top 10 cars you are interested in buying, and then follow the rest of the steps in this guide. We promise the next one is a fun one 😉

5. Time for a test drive

Using the list you’ve made with your top 10 favourite cars, it’s time to get behind the wheel and “put the pedal to the medal” as they say. When buying a new car, it’s safe to assume that the car is in perfect working condition. For a new car, test driving is really more about seeing if you feel confident driving the vehicle, to see if it’s spacious enough and most importantly whether it meets all your requirements. You’ll also need to check if you are able to reach the controls and steering wheel comfortably.

If you are looking to purchase a second-hand vehicle then you need to pay much closer attention when test driving to check for any noticeable squeaks or rattles. Everything from all the buttons and indicators working to checking all the doors open smoothly and the windscreen wipers are fully functional. When you start up the engine, make sure to give it a good rev, this way you’ll be able to make sure that there aren’t any knocking noises.

6. Check reviews & service records

The whole point of purchasing a car is for you to get from A to B safely, so this is a very important step to consider before actually purchasing a car. We’d start off by reading the reviews about the car you are wanting to buy both cars.co.za and carmag.co.za offer great reviews of almost any vehicle available in SA. Reviews can give you a good idea of the car’s quality, but they won’t be able to tell you if the car is issue free.

When going for a test drive, ask the car owner if you can view the service book. This way you’ll be able to get a full picture of any accidents or repairs that have happened over the years. If you decide to purchase a used car, the service history should give you a clear indication of whether the previous owner took adequate care of the car or not.

7. Ask for an inspection

If you are still concerned about the car after a test drive but are still pretty keen on purchasing it, then ask the car owner if you can get a mechanic to inspect it. This will obviously come at an additional cost, which you’ll need to cover as the potential buyer. However, a mechanic inspection might save you plenty of money in the long run if they are able to pick up any faults with the car. Although this isn’t very common in South Africa, asking for an inspection is still something potential buyers should consider. An inspection will allow you to see if there are any serious issues with the car that were missed in the last service (or potentially that the seller is trying to hide).

If you don’t want to pay for a professional mechanic, it’s always a great idea to get a second opinion, so take a family member or friend along with you when test-driving the car. This way you’ll be able to make a well-informed decision.

8. Pay off your previous car

Now it’s time to talk finances. If you don’t have the cash right now (or don’t feel like spending it outright on a car), vehicle finance is your next bet. it’s not advisable to take out a new car loan when you haven’t paid off the previous one. For car dealerships and car resellers like WeBuyCars it’s for more attractive to sell a car that’s already been paid off in full, and it’s less risky for you as the potential buyer of a new car. Yes, it would be nice to trade in your car every few years for the latest and greatest, but that’s very risky business.

In addition to that, paying off your previous car will also give you extra money to work with – this can either be put away into a savings account, or it can be used towards a deposit when applying for vehicle finance. Taking out a new car loan when you haven’t paid off the first car can also negatively impact your credit score, and lower your chances of getting approved (or pre-approved) for vehicle finance.

9. Compare vehicle finance offers

This step can either be number 9 or number 1, we thought we’d saved the best for last (well almost). If you want to go the route of getting vehicle finance, pre-approval will determine what budget you have to work with, and what type of cars you can potentially buy. Keitzman is an alternative auto financing lender, who works with five of the major South African banks to get pre-approval. If you are unsure where to even start with vehicle finance Fincheck is able to compare offers to potential buyers in a couple of minutes. All you’ll need to do is follow the 3 step application, and you’ll be matched with lenders based on your requirements.

How does vehicle finance work? Well, it’s the quickest and simplest way to get access to a vehicle you can one day own. This is done with a lower interest rate compared to other personal loans and usually a much longer repayment period. The financial institution will own the vehicle until you have paid your very last monthly instalment and any outstanding debt (like a balloon payment).

Monthly instalments make it possible for many South Africans to have their own personal method of transport without using all their precious savings that can rather build an asset. Your monthly instalment will be an amount calculated using the cost of the vehicle, your available deposit amount, the interest rate and the time period over which you are able to pay it off.

10. Vehicle insurance

You’ll never be sorry for playing it safe, and vehicle insurance gives car owners peace of mind. Although it’s not mandatory to have car insurance in South Africa, it’s strongly advised, especially because of the the high number of accidents and vehicle thefts. If you are financing your car, it is however, very much compulsory. The financial institution that finances your vehicle will either insure the car themselves (at your expense) or require proof of insurance. If an accident does happen and you do not have car insurance, you will be liable to cover all the costs from your own pocket. These costs are usually large and can be financially devastating. Therefore, it is a wise choice to choose the right insurance that fits into your monthly budget, but that also covers you for all unforeseen events. If vehicle insurance is another rabbit hole you’d prefer not to go down then platforms like Fincheck allow you to compare vehicle insurance in South Africa in under 5 minutes.