Let’s be honest nobody really likes the word tax, let alone actually spending time and energy filing your personal income tax return on time. Although we’d all like to be sipping Pina Coladas in the Cayman Islands, the reality is that taxes in South Africa are unavoidable and whether we like it or not they come around once every year. We thought we’d help you on your way when it comes to filing your income tax, and who knows maybe you’ll actually enjoy the process and if you are fortunate enough you might get some money back from the taxman.

Let’s kick off our how-to guide on filing your personal income tax, by updating your South African tax knowledge.

What is personal income tax in South Africa?

Personal income tax is a tax that is put on income and profit that is received by a taxpayer. It is the main source of income for the national government and is imposed by the Income Tax Act No. 58 of 1962. According to SARs, there are a number of amounts South African residents may receive which can be taxed, these include:

- Remuneration (income from your employment) e.g. salaries, bonuses, fringe benefits and allowances.

- Profits or losses from a business or trade

- Pension income

- Investment income – interest or foreign dividends

- Annuities

- Incomes or profits from being a beneficiary of a trust

*These are just a few examples

How do I know if need to pay income tax?

You are liable to pay personal income tax if you earn within the South African tax bracket.

These are the tax thresholds according to SARS:

For the 2025 year of assessment (1 March 2024 – 28 February 2025):

- R95 750 if you are younger than 65 years.

- If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R148 217.

- For taxpayers aged 75 years and older, this threshold is R165 689.

For the 2023 year of assessment (1 March 2022 – 28 February 2023)

- R91 250 if you are younger than 65 years.

- If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R141 250.

- For taxpayers aged 75 years and older, this threshold is R157 900.

For the 2022 year of assessment (1 March 2021 – 28 February 2022)

- R87 300 if you are younger than 65 years.

- If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R135 150.

- For taxpayers aged 75 years and older, this threshold is R151 100.

- For the 2021 year of assessment (1 March 2020 – 28 February 2021)

- R83 100 if you are younger than 65 years.

- If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R128 650.

- For taxpayers aged 75 years and older, this threshold is R143 850.

What is PAYE?

Employees’ tax in South Africa is known as Pay-As-You-Earn (PAYE), this is the tax required to be deducted by an employer from an employee’s remuneration paid or payable. South African employers are required to be registered with SARS for PAYE and/or Skills.

Below is a breakdown of PAYE:

2025 year of assessment

| Taxable income (R) | Rates of tax (R) |

| 1 – 237 100 | 18% of taxable income |

| 237 101 – 370 500 | 42 678 + 26% of taxable income above 237 100 |

| 370 501 – 512 800 | 77 362 + 31% of taxable income above 370 500 |

| 512 801 – 673 000 | 121 475 + 36% of taxable income above 512 800 |

| 673 001 – 857 900 | 179 147 + 39% of taxable income above 673 000 |

| 857 901 – 1 817 000 | 251 258 + 41% of taxable income above 857 |

| 1 817 001 and above | 644 489 + 45% of taxable income above 1 817 000 |

How do I register for SARS eFiling?

If you are a registered taxpayer already, then you’ll easily be able to sign up for SARs eFiling service. If it’s your first time filing your taxes online, SARS has made the entire process simple and fast. To register as an eFiler, you’ll need to visit www.sarsefiling.co.za and click REGISTER, alternatively you can download the MobiApp and get started.

During the registration process, SARS will verify all your personal information, once your registration is complete, you’ll be notified by email and you’ll receive an OTP.

How do I file my personal income taxes on eFiling?

Step 1: Login to SARs

First, you’ll need to head to www.sars.gov.za, and navigate to the right-hand side of your screen and click ‘Login’. Once you’ve entered your username and password.

Step 2: Request your ITR12 tax return form

Once you’ve logged in, you’ll need to double check that your name and ID number are shown on the left hand side. In the menu bar click on ‘Returns issued’ this will take you to your ‘Personal Income Tax’ form (ITR12). Once you’ve clicked on ITR12, a questionnaire will pop up. This wizard will guide you in customising your ITR12 return. It’s important to remember that you’ll only need to update the information if your tax affairs have changed over the past year. If you’d like to add additional income and deductions sections to your ITR12 return, select the relevant options on the wizard. Once completed click ‘Create Form.’

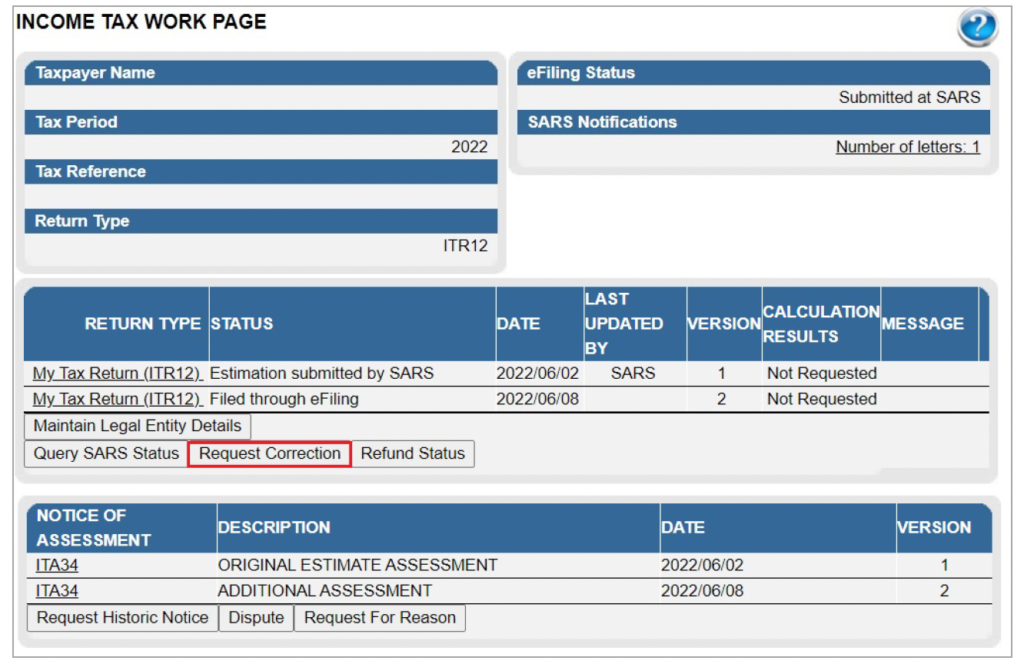

Note: As of 2022, SARS will issue “Original Assessments based on Estimates”. Here you will receive the “Notice of Assessments” for the applicable year as opposed to the simulated assessments that were issued previously. You won’t be required to do anything if you agree with the assessment issued by SARS. If you don’t agree with the assessment issued by SARS, you will still have the opportunity to file your own original return within a stipulated period to avoid penalties being imposed.

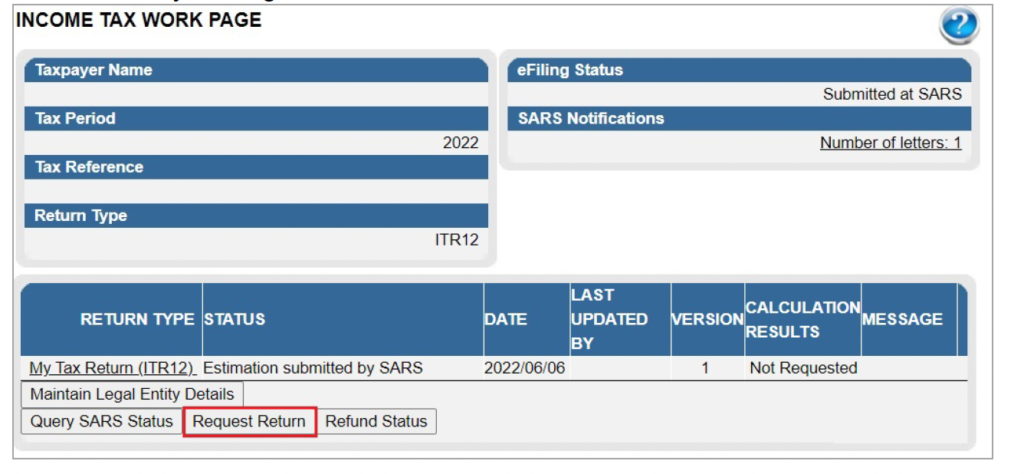

If you’ve been given an auto-assessment, you’ll be able to click ‘View Return’, here you’ll be able to view the ITR12 and edit your return. If you’d like to edit the return and declare further income, you will be able to make changes by selecting ‘Edit Return’. If you choose to edit the return, the regular return filing process will apply, and the submitted declaration would be recorded as the original assessment from the taxpayer. If you were not given an auto-assessment (or just want to DIY it), you’ll need to select ‘request return’ and fill in your required details manually on e-filing.

Step 3: Completing your income tax return via eFiling

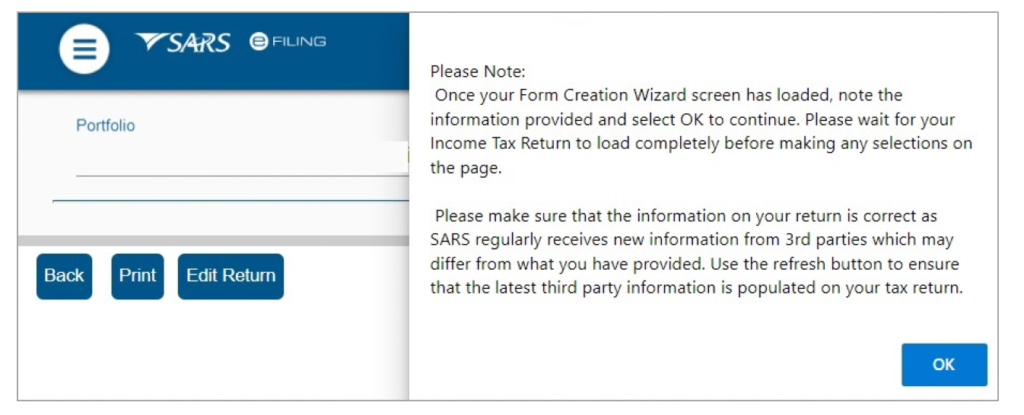

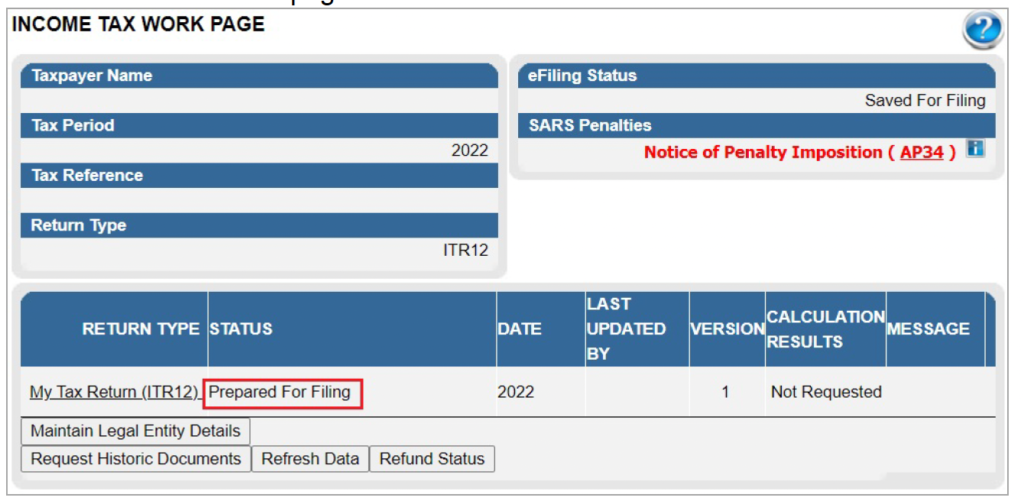

After you’ve requested your return, you’ll land on the “Income Tax Work Page.” You’ll see a message informing you that your Income tax return has been generated and that it contains the latest information SARS has on record for you. Read the message carefully and select “OK” to continue. If your Income tax return has been issued, it will appear in the “Income Tax Work Page” grid. Depending on which wizard options you selected, you may need to complete sections or “Request Corrections” on additional income and deductions.

If you’d like a more detailed explanation of how to complete your income tax return, and the various sections that will be applied during the assessment process of the return contained in the Acts: Income Tax Act No.58 of 1962 and the Tax Administration Act No 28 of 2011, refer to the ‘Comprehensive guide to the ITR12’ published on the SARS website.

Step 4: It’s time to submit your tax return

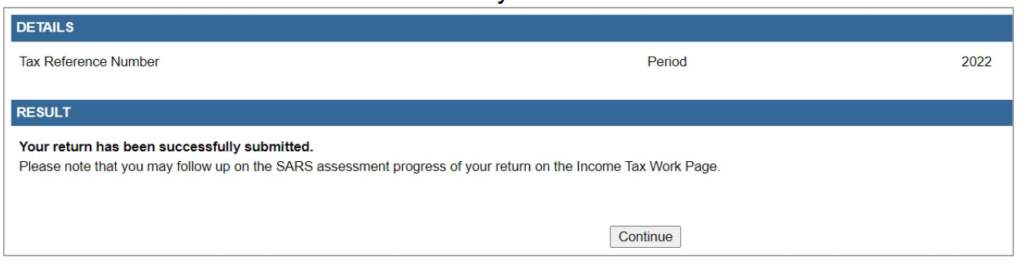

At any stage, you can save your Income tax return by clicking on ‘Save’. After completing your tax return and selecting ‘Save Return for Filing’ button, a screen will be displayed to indicate that your return has NOT been filed. The status of your income tax return will be indicated as ‘Prepared for Filing’ on the Income Tax work page. Once all the information has been captured on your Income tax return and you are ready to submit it to SARS, simply click ‘Submit return to SARS’. Once you have selected this a declaration screen will be displayed with the date of submission will be prepopulated. Here you’ll need to click ‘Confirm’ if you’d like to submit the final return to SARS or ‘Cancel’ where you’ll then be returned back a step.

If you chose to submit a return, the ‘Query SARS Status’ button will appear on the Income Tax Work Page, here you’ll be able to query the status of your filed tax return (the waiting period is generally two weeks). If your tax return is still in process, the status on the Income Tax Work Page will be indicated as ‘In Progress’.

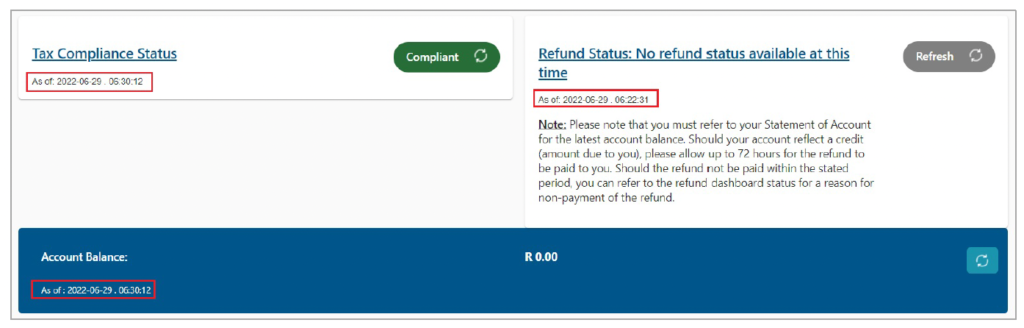

Step 5: Get a refund or make a payment

If your assessment result indicates that you owe SARS, you can make a payment from the Income Tax Assessment page. You’ll then need to click ‘Make Payment’ followed by ‘Pay Now’, and the last step is clicking ‘OK’ on the confirmation message, then follow the prompts.

If you are legible for a tax refund, your ‘Refund status’ will indicate if you are to receive a refund or not. It also states that any refund due to you (if applicable) will be processed after your banking details are received and verified.

And that’s a wrap – you are now done and dusted (until next year)! If you’d like to know how you can qualify for a tax refund, our friends at TaxTim have given us a few tips below.

Frequently Asked Questions about personal income tax:

How do I calculate what taxes I owe?

If you’d like to find out an estimate on what taxes you owe, there are many tax calculators available online. Sage’s tax calculator is in line with 2022/2023 Budget Speech. All you’ll need to do is enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

How do I calculate my tax refund?

If you are lucky enough, you might qualify for a tax refund from SARS. Then we’d suggest using TaxTim’s SARS Tax Refund Calculator for 2022 for an estimate on your tax rebate amount.

What is the difference between an IRP5 and an ITR12?

SARS filenames can be confusing, so let’s explain the difference between ITR12 and IRP5. ITR12 is the Income Tax Return for all individuals (including provisional taxpayers) for a particular tax year. An IRP5 is just a summary of all your payslips for the year.

What happens if I want to correct my tax return?

If you’ve realised that you have made an error while completing your return, then you’ll need to select ‘Request for Correction’. This process allows you to correct a previously submitted return.

Do you have to pay foreign income tax?

In short yes, if you’ve decided to leave South Africa but have remained a South African resident, you will be taxed on all your foreign and local income.

On the flip side, if you are living in SA but receiving a salary from an overseas company, you’ll still file your tax return normally.

If you do choose to immigrate or work overseas for a portion of time, there are some exemptions to paying taxes. According to Section 10 of the Income Tax Act, there are several conditions where money earned while outside of SA will be exempted from income tax. If you are living and earning abroad the foreign income cap is R1.25 million per year, meaning if you earn above this amount, you’ll need to pay taxes back in South Africa too.

How can I improve my credit health before tax season?

Easy, all you’ll need to do is get your free credit score, and enrol in our credit health course on Fincheck Academy.

What is an IRP5?

An IRP5 is a tax certificate issued to employees at the conclusion of each tax year. It provides a comprehensive breakdown of all incomes, deductions, and related taxes associated with the employer-employee relationship. The purpose of the IRP5 is to assist employees in accurately completing their income tax returns for the respective year.

When should I receive my IRP5 from my employer?

Employees typically receive their IRP5 tax certificates at the end of each tax year. The specific timing may vary depending on the country and the employer’s practices. In many countries, such as South Africa, employers are required to issue IRP5 certificates to their employees by a certain deadline, which is usually around the end of May. However, it’s important to note that these timelines can vary, so it’s always best to consult local tax regulations or check with the employer for the exact date when IRP5 certificates will be sent out.

Reference: All the information from this blog post was adapted from the SARS website and guides. This guide was updated on 1 June 2023.