Let’s be honest in between your long list of daily tasks, we are pretty sure you are taking a five-minute break to complete your Wordle for the day (if you aren’t we suggest you should – seriously!). Obviously, we are in the business of finance, and because we know a thing or two about financial jargon, chances are a couple of these words might pop up on your daily Wordle puzzle.

Why should you read on? Well, we are going to help you kill two birds with one stone, firstly we will give you a couple of Wordle inspo words and secondly, you’ll learn a bit more about finance – and you know what they say Knowledge is Power.

How did Wordle start?

It all started with a love story (and not like the Taylor Swift song), between a software engineer and his partner. Josh Wardle was inspired by his wife who loved word games, so he created Wordle online just for the two of them to play. In the beginning of Jan 2022, it became a global craze with hundreds of thousands of people taking part in the five-letter word puzzle. Soon after it became a sensation, The New York Times bought it for around $1million USD (although the exact figure is not known).

Is there a way you can cheat in Wordle?

Much like snake or minesweeper (oops are we showing our age?!) why cheat yourself of such a simple and engaging guilty pleasure that is taking the world by storm. Although there is a simple way to “crack the code”, it really spoils the fun. So instead, we are going to give you a couple of 5 letter finance words to give you some inspiration for your next Wordle game.

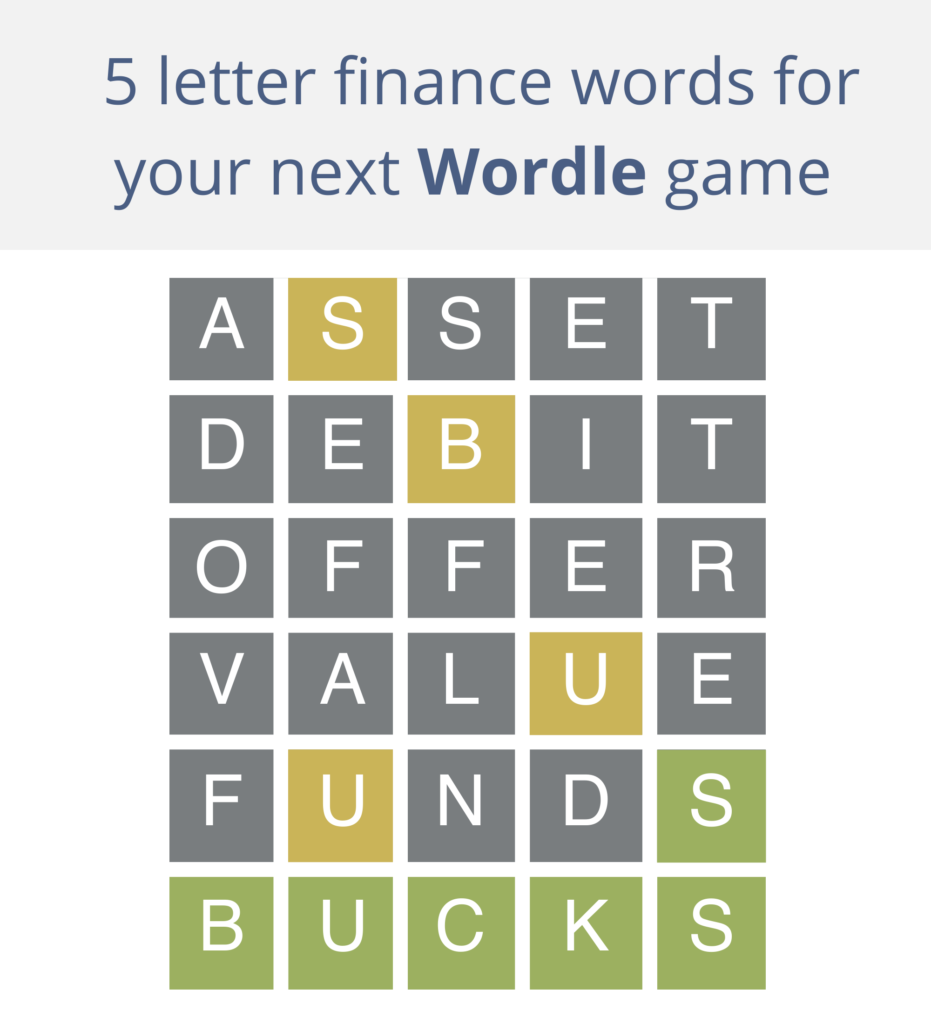

A-Z of 5 letter finance words for your next Wordle

Asset – An asset is something with value. It’s worth something. You can sell it for cash or you can keep it to capitalize on its growth potential (possible increase in value). Assets may require a bit of maintenance (costs to ensure its upkeep), but assets cause income or growth in wealth.

Audit – in accounting terms, this is an official inspection of a business’s accounts, this is typically done by an independent body e.g. Deloitte.

Debit – A debit is an accounting entry, it can either be classified as an increase in assets or a decrease in your liabilities. So, for example, if you take out debit order to buy a cellphone, this is a commitment between you and a third party to take an agreed amount of money out of your bank account every month to pay for that particular product.

Debts – Debt is a sum of money that is owed/due to someone else. When you loan money and take out a credit card, you will then have debts that you need to pay off.

Funds – a sum of money saved or made available for a particular purpose. An investment fund is capital that belongs to a number of investors and is used to purchase securities.

Grant – a grant is a sum of money that is given to an individual or organization by a government or other organization for a specific purpose.

Index – in simple terms an index indicates or measures something. More specifically in financial terms, it refers to the statistical measure of a change in a securities market.

Lease – a lease is a legal contract between two parties. A financial lease is a type of lease where the financial institution is the owner of an asset, and the borrower rents the asset for a specific period of time.

Limit – in financial terms, this is the maximum amount you are allowed to spend. For example, your credit limit on your credit card might be R50 000, which means you are capped at spending R50 000.

Loans – a loan is a sum of money that is borrowed with the intention of paying it back with interest in a specific period. A personal loan is money borrowed for personal use. This money is borrowed from a lender with the expectation you will pay it back based on the loan terms.

Offer – An offer is when you provide something to someone with the intention of them accepting or rejecting it. If you receive a loan offer, you’ll be able to decide if it’s suited to your financial needs.

Party – by definition means a group, in financial terms when you refer to a third-party, this could mean a buyer, and seller enter into an agreement and a third party assists the transaction. Purchase Order Finance lenders are a great example of a third-party transaction.

Proxy – in business, a proxy is a person which is assigned by another individual to attend a meeting or sign financial documents on their behalf.

Quote – is the estimated price for a job, service or product. e.g. I received a quote to have my roof fixed.

Score – score means the number of points. In financial terms a credit score is a measure of your ability to repay your debt, a number is attached to this score and ranges from 330 to 850.

Taxes – are a compulsory contribution you need to make to the government, income tax is levied on your income and profit.

Trade – the action of buying and selling goods and services e.g. I did a trade in for my car and received R180 000.

Trust – in financial terms, a trust is an agreement where a third party or trustee holds assets on behalf of a beneficiary.

Value – in finance terms, this refers to the estimated monetary value of a particular thing. E.g. your car is valued at R200 000.

Yield – Something that yields brings an increase. Financial tools with a good yield bring much increase in value or an increase in money.

Bonus slang finance words

Bread – an informal term for money or income e.g. I bring home the bread for my family.

Bucks – another slang term for money, this word traces back to America where deerskins were commonly used to trade goods. e.g., that coffee will be 38 bucks.

Dough – no we aren’t talking about cookie dough; this is another term for money e.g. I’d like to be earning some extra dough.

Grand – this refers to multiples of 1000s e.g. A new TV is going to set you back 5 grand.

—

If none of these words are the Wordle of the day, at least you learnt something new about finance – plus …

If you’d like to know about the A-Z of financial terms, read our dummy guide.