When the festive season finally nears closer it becomes increasingly more difficult to save money. Buying Christmas gifts, weekend getaways and braais can all add up over the summer holidays, that’s why it’s so important to put together a savings plan before the time. South Africans find it very difficult to save, and according to BusinessTech South Africa’s survey from Jan 22, the majority of respondents said they only saved 15% of their salaries, and in addition to that 35% said they did not save at all.

Respondents in their 40s contributed 43% of their salary to their retirement fund, and those in their 50s contributed 60% of their salary. We know saving can be tough, and sometimes it’s starting out that’s the hardest part. We’ve put together a couple of tips to help you along the way.

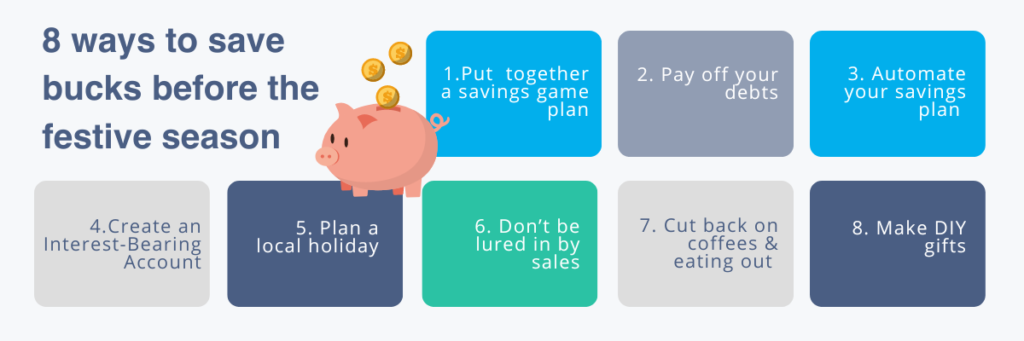

8 ways to save bucks before the festive season

Staying on top of your finances come sometimes be difficult to do, so here are a few ways you can save some moola and make changes in your day-to-day life:

1. Put together a savings game plan

Your savings goals should be visualised from the get-go. What better time to get started on your saving journey than now (before you spend too much over the busy season). A good starting point is calculating what you’ll be able to save each month based on your current salary (after tax) and expenses. If you are able to save you should start by saving at least 10% of your salary, as you earn more and have paid off your debts you can look at saving more. Let’s say you want to buying a house at the start of next year, or at least saving towards a deposit, make sure your savings game plan has both your short-term and long-term savings goals in mind.

2. Pay off your debts or consolidate your debts

A common issue many South Africans face is that they are so often bogged down with debt that they can’t even begin to save. Budgeting is a good way to save money, but often large debt burdens can leave you in a bit of a pickle. Start off by putting together a spreadsheet of all your debts e.g. your credit card, clothing store accounts, personal loans and home loans, even money you owe a family member or friend. For any short-term credit, or smaller loan amounts try and pay them off as soon as possible. Your long-term loan payments don’t need to be part of your short-term savings goals, but they are good to keep in mind. If you have too many loans to keep track of, it might be time to consider debt consolidation, this way you can consolidate all your debts into one central loan, making it easier to pay off and keep track of.

3. Automate your savings plan

The last thing we want is for you to get too excited when your salary hits your bank account, so the safest thing to do is to set up a debt order of a certain amount to come off your current account each month into your savings account or an investment account. Whether it’s R500 or R2000 a month, make sure you stick to your guns and continuously contribute towards your saving goal.

4. Create an Interest-Bearing Account

Once you’ve decided on the amount you’ll be saving each month, it’s strongly advised that you should put your money into an interest-bearing account, whether it’s standard savings account linked to your bank account or an investment account, either way, you want to make sure your money is gaining interest.

5. Plan a local holiday

With the rise of fuel prices in South Africa travelling can be expensive, especially if you were planning on flying somewhere for the summer holidays. Why not have a close-knit holiday at home over the Christmas period, this way you can cut down on petrol and accommodation costs. Also if you are a bit tight on the cash flow, rather invite your family over for a bring and braai at your house.

6. Don’t be lured in by sales

Whether it’s Black Friday, CyberMonday or Christmas sales, steer clear of the word sale altogether, especially if you are trying to save. There is only one exception, and that’s if you’ve had something on your shopping list for a while and it’s a necessity then look at whether buying it on sale is a cheaper option. Often retailers mark up their prices during the busier periods and then claim that the items are on sale, be aware of this scam.

7. Cut back on coffees & eating out

It can be so easy to say yes to a coffee with your colleague, especially if you suffer from FOMO. If you really need to join them for the social aspect, then ask if you can walk with them to the coffee shop for some fresh air. In addition to cutting back on the daily cappuccino, look at making eating out and getting takeaways a less frequent habit. Prep meals on a Sunday night and take them in for office lunch.

8. Make DIY gifts

Consumerism can often take over during the festive season, with people forgetting what the holiday period is all about. Whether it’s a Christmas or birthday present, don’t feel the need to buy extravagant gifts. Instead, make fun and affordable DIY gifts. Pinterest is your best friend for inspiration for holiday gifts.

How can I get my credit health back on track?

First, you’ll need to get access to your credit score, MyFincheck allows South Africans to do this in a couple of minutes with their free credit report. If you’d like help with understanding your credit report as well as working towards a much healthy credit score then enrol in our credit health course.

How can I improve my cash flow?

Staying on top of your financial health is a vital step in making choices towards a better financial future. One way to do this is to stay in control of your cash flow and keep it positive. If your cash flow is negative – more cash flowing out than coming in – it probably means you have taken a bit of a knock (eeeek!) and you are in need of help. Follow our 5 quick tips to improve your cash flow in no time.