A personal loan is an ideal solution if you need to overcome a financial hump, whether it’s a big-ticket item like a home renovation, or a smaller purchase like a vacation – either way it’s designed to help you out when you need it most.

There are many different types of personal loans available in the market. However, not all of them are the right fit for your needs. Yes, applying for a personal loan can sometimes be as easy as 1,2,3, but not every application is the same, so we’ve put together 5 steps that will help you with a smooth personal loan application in South Africa.

Before we jump right in, you’ll need to get your financial knowledge up to scratch, so let’s walk you through a couple of common terminologies and questions on personal loans.

What is a personal loan?

A personal loan is a type of credit you can receive from a lender. The borrower will take out this type of loan for one-off expenses, from an upcoming wedding to furthering your studies. A personal loan is generally an unsecured loan, meaning it isn’t backed against a property or other form of assets.

How much can I borrow?

Obviously, this depends on many factors, including your salary, credit score, and spending habits. Personal loans generally range from R1 000 to R250 000.

Need help finding out what your credit score is? Use MyFincheck to get your credit score in minutes.

How do I apply for a personal loan?

Most lenders or comparison sites have made the process as simple as possible. At Fincheck all you’ll need to do is fill in the 3 step process and you’ll have loan offers in minutes. Each lender has a similar application process, you’ll need to supply your personal details, bank statements and proof of income.

Great, now that you know a little bit more about personal loans, follow our step-by-step guide below:

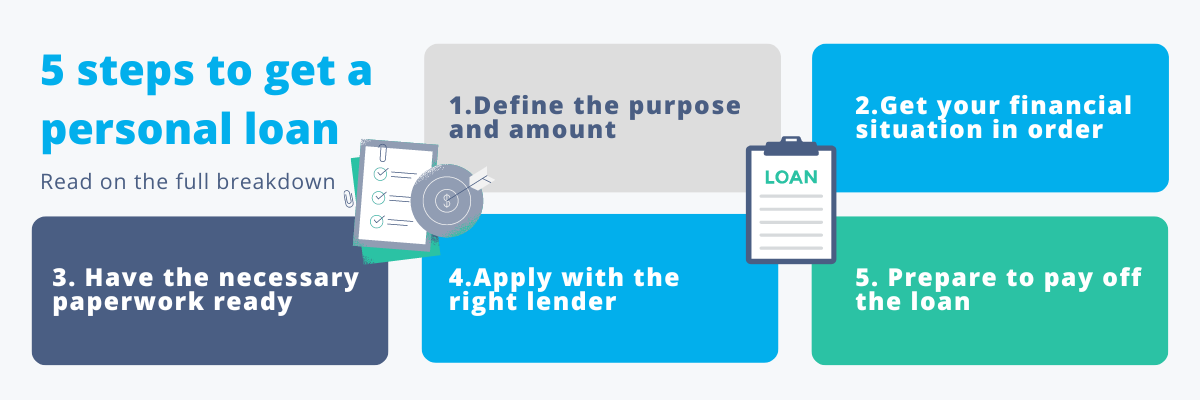

5 steps to get a personal loan in South Africa

Step 1: Define the purpose and amount for the personal loan

A personal loan is not something to be taken lightly, which means you really need to define why you need the loan, and how much exactly you’d like to borrow before starting with the application process. It’s important here to look at your current finances, what you have in savings and your current account, and if you are willing to use money from your savings or if it’s a smarter idea to be applying for a loan.

Whether it’s a R5000 or R100 000 personal loan you are looking for, you’ll need to calculate the exact amount you need funding for. Let’s say you are wanting to buy a bicycle to get from A to B, if it’s in pristine condition don’t ask for more money than the retail price of the bicycle, however, if it’s a second-hand bicycle you might need to factor in a bicycle service, new chain and tyres. At the end of the day, you’ll need to take into account all costs involved for what the purpose of the loan is, however you don’t want to put down an amount you simply can’t afford.

Step 2: Get your financial situation in order

Before you click the ‘Apply Now’ button it’s a wise decision to make sure everything, and we mean everything is in order with your finances. A good starting point is getting access to your credit score. Your credit score is essential in helping lenders decide on whether they will fund a personal loan, and what the interest rate and the loan amount will be. MyFincheck is a great tool if you’d like to get access to your score for free. Once you have access to your credit score, you’ll need to make sure all your finances are in check.

Start off by paying off any overdue debt e.g. your credit card, if you are struggling to keep track of all your loans, then it might be time to consider debt consolidation. If your monthly income is sitting pretty low, this might be the best time to ask for an increase or look for a side-hustle as an additional revenue stream. Lenders will be looking at your credit score, your monthly income and transaction history to make a decision on a personal loan, so make sure your finances look as healthy as possible. If you are struggling to keep your credit in the healthy zone, our credit health course will set you on the right path.

Step 3: Have the necessary paperwork ready

Option 1 – Traditional Way

Paperwork is possibly the most tedious step in your loan application process, so to avoid any bumps along the road make sure you have everything ready so that the process is as easy and quick as possible. If you are applying directly with a bank, you’ll need to provide documentation to the lender in order to qualify. Here are the 3 most important documents you’ll require (these requirements vary by lender):

- Proof of identification: A passport, driver’s license, ID document.

- Proof of address: A lease agreement or

- Proof of income: Pay stubs, bank statements or tax returns.

Options 2 – Fincheck’s innovative approach

Our personal finance marketplace platform makes the application process that much easier. In 3 quick clicks, you’ll be able to fill in our application, using our seamless end-to-end process. Document collection and verification all happen in one central place so that when it comes down to comparing offers it can happen in a couple of minutes.

Application tip: we would suggest saving the required documents in a JPEG and PDF format, in addition to that it’s advisable to compress the document size so you don’t have issues during the upload. Tools like SmallPDF.com are very useful for this.

Step 4: Apply with the right lender

Now you can actually get started on the fun part – the application. Although most lenders and marketplace platforms make it as easy as possible to apply for a loan, you’ll still need to find the ‘right’ lender. What exactly is the ‘right’ lender? This lender has a competitive interest rate, flexible loan terms, and an application process that is easy to understand – all in all, it needs to be a financial institution that meets all your needs.

At Fincheck we’ve taken it one step further by giving you the choice to compare loan offers all on one platform, so you can make an informed decision. In our 3-step application process, you’ll be able to apply for a loan, provide us with all the necessary documents, and we will use the information provided to match you with multiple reputable lenders. Here you’ll be able to compare interest rates, loan terms and loan offers. Once you have decided on your chosen lender, you’ll be able to apply through our platform, and the lender will make contact with you about the next steps.

Once you have applied for a personal loan with the right lender, you’ll just need to be patient for an answer on approval. In most cases (and if you’ve followed our tips 😉), it should take a couple of days between approval and disbursement.

Step 5: Prepare to pay off the loan once approved

This step doesn’t really affect whether you will get a personal loan or not, but it’s just as important as step 1. A debt management plan is something you’ll need to prepare for from the get-go. As soon as you’ve been approved for funding create a detailed budget and save up enough money to pay off the loan when it becomes due. D-day will come soon enough, and you don’t want to miss a payment, as this will negatively impact your credit score and damage your chances of applying for a loan again. Set up a game plan, and make sure you stick to it – it’s as easy as that.

A personal loan is designed to help bandage your current financial difficulties, it’s a short-term solution and the intention is to pay it off on time and regularly. Our step-by-step guide is aimed at giving you the necessary tools to get faster and more affordable personal finance. Now all you need to do is weigh up the pros and cons, and decide whether to get started on the application.

Frequently asked questions about personal loans in South Africa:

What are the terms of a personal loan?

This again depends on a number of factors and varies from lender to lender. Your repayment period can range from a minimum period of 3 months to a maximum of 72 months. A pretty standard contract term across the board is that you’ll need to make monthly instalments over the loan period.

How is personal loan interest calculated?

When you take out a personal loan, you will obviously want to know how much you will have to repay in interest. This can be difficult to calculate without knowing the exact interest rate that you will be charged. You may also want to know how this is calculated. It’s important to look at the fine print, your annual percentage rate (APR) is the best indicator of determining your interest rate.

There are many different factors that influence the interest rate you’ll receive on your personal loan, read our blog post on how personal loan interest rates are calculated in South Africa?

Which bank has the lowest interest rate for personal loans?

We’ve done the legwork and rounded up the five best banks leading the way for low-interest personal loans in South Africa.

Helpful financial jargon:

APR (Annual percentage rate) – this is a yearly form of interest, charged on your credit. Your APR determines how fast credit will accumulate on your debt.

Simple interest – your interest rate, in this case, will be calculated on your principal loan amount over a period of time. Your principal loan amount will remain the same, and your total repayment amount will be calculated using this interest.