Whether it’s for online shopping, getting by some months, or simply because it’s easier than carrying cash around, credit cards can offer great benefits to any consumer. Whatever your reason for needing a credit card, chances are you don’t want to deal with the hassle of a bumpy application process.

If it’s your first time applying for a credit card, you may not even know where to start – and that’s where we want to help you out. Our credit card guide will walk you through everything you need to know for a smooth application process.

What is a credit card and why do I need one?

A credit card is a line of credit which is either issued by a bank or financial institution. A credit card allows you to lend money from that institution. As the cardholder, you agree to pay the money back with interest, according to terms laid out in your terms and conditions.

Getting access to a credit card is a pretty big deal and the decision should not be taken lightly. Because a credit card can be used for a number of financial reasons, it can cause havoc in the wrong hands. But when used responsibly, it offers tons of benefits. It’s easier than applying for a personal loan, it can help provide you with emergency funds, help finance big purchases, and protect you from fraud. A credit card is also a great way to build up credit history.

What is a credit score?

A credit score is a number that provides a measure of the creditworthiness of a person. It is based on the credit history and financial information provided on that particular person. Credit scores are used by lenders to determine whether the borrower is likely to repay a loan.

It is important for borrowers to understand how their credit score is calculated because it affects what interest rates they will be offered when borrowing money from lenders such as banks or credit unions.

The 4 largest credit bureaus that create credit reports in South Africa are:

Credit bureaus work to keep track of your credit history here in South Africa. They take this history and turn it into a document called your credit report. The information on your credit report translates to a single score that basically rates your ability to repay debt. A credit score usually ranges between 0 and 999. Higher scores are considered stronger and better. Lower scores are not so good. Your credit score directly affects your ability to apply for a credit card, the limit on your card and the interest you’ll receive. We will cover your credit score and its effect on your credit card application in more detail below.

A good starting point is to find out what your credit score is, a free tool like myFincheck is a great place to get access to it.

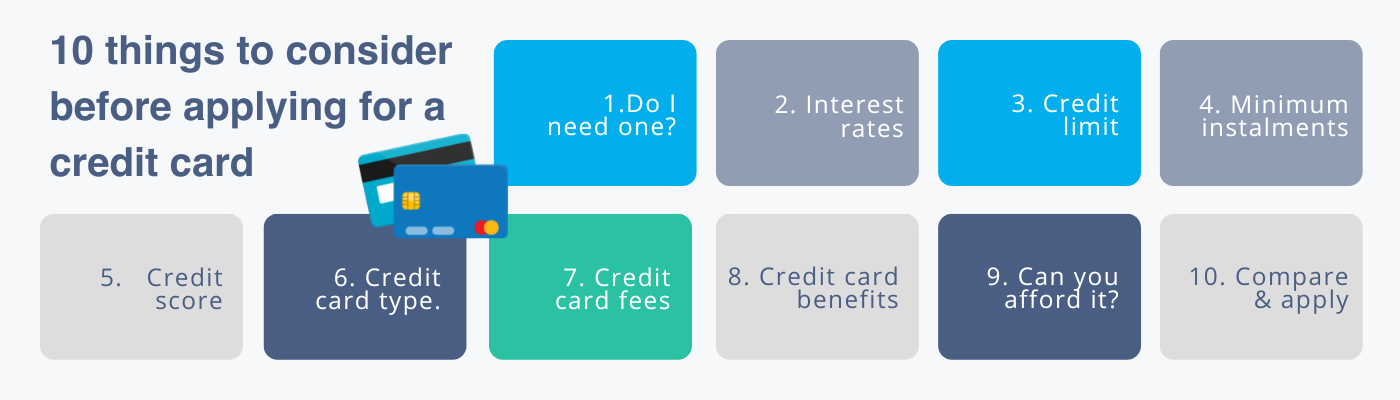

As a famous Marvel character once said “Remember, with great power comes great responsibility.”, and taking out a credit card is a very powerful financial tool, but it comes with great risk and responsibility. We’ve unpacked the

10 ten things you’ll need to consider before applying for a credit card:

1. Do I really need a credit card?

This is probably the most important step when it comes to a credit card – do you actually need it and are you financially ready? You should weigh up all the pros and cons of a credit card before starting the application process.

When you first open up a bank account in South Africa, you are likely to be issued with a debit card, which might seem similar to a credit card – with the ability to make transactions and VISA or Mastercard plastered on the side. However, the biggest difference is that the one requires you to have money in the bank and the other doesn’t. With a debit card, when you make a transaction, it comes off your current account.

A credit card, in contrast, allows you to make transactions without any money in the account and you’ll then be able to repay the money with interest at a later stage. If it is a credit card you are in need of and you are ready, then we will get to a couple of other important aspects of the process later on.

But in a nutshell, here are a few simple pros & cons to consider before applying for a credit card:

PROS

- Security – more secure than carrying cash, especially for fraud

- Benefits – airmiles or discounts at certain retailers

- Easy online shopping – must online retailers take credit cards instead of debit cards, especially international retailers

CONS

- Overspending – it’s easy to spend more than you can afford

- Lower credit score – having many credit cards can damage your credit score

- High-interest rates – if you fail to pay your credit card off on time you will face high-interest rates.

2. Interest rates on credit cards

Whether you are applying online or in person, a critical factor is the interest rate on the credit card. An interest rate is used to calculate the amount that you will pay the bank back for borrowing the money. In your terms and conditions, it will be stated at a yearly rate – this is called an Annual Percentage Rate (APR). If you’d like to avoid paying any interest on the money borrowed, then pay your balance in full each month. You can avoid paying any interest on transactions if you pay the outstanding balance in full each month.

It’s important to check your terms and conditions to see what the repayment date is each month so that you can pay it off before the date to avoid high-interest rates.

Let’s say you don’t pay your balance off in full at the end of the month, if this is the case you’ll be charged interest on the outstanding balance.

Credit card interest rates are calculated in the following way:

The daily rate you’ll pay interest on is calculated by dividing the APR (annual percentage rate) by 365 days. For example, if you have an APR of 18%, the daily interest rate will be 0,049%. So let’s say you have an outstanding balance of R400 on day one of opening your bank account. On day two you’ll have an outstanding balance of R400,19, as you’ll have earned R0.196 on that day, then each day going forward the interest will accumulate.

If you’d like to find out what your monthly instalments will be once you’ve reached your credit limit, the FNB credit card interest rate calculator is a great tool for finding this out.

3. The sky is not the limit

If you’ve watched any Hollywood movie, credit cards seem like the ultimate tool to get whatever you desire. And although this is true (partially) – it does come at a cost and a limit.

You cannot spend as much as you’d like on your credit card, and almost always your credit card agreement will come with a credit limit. The credit limit is the total amount of money that you will be allowed to spend on your credit card. This is not per month, or yearly – but rather the maximum amount you’ll be able to use on that specific credit card. Here are a couple of things that determine your credit limit:

- Current income and expenses

- Your credit score

- Payment history

- State of the economy

In essence, if you earn more and have a good credit score, you will often be given a higher credit limit. It’s important to note, that the longer you have that specific credit card, and if you pay it off on time each month, the lender is likely to give you a higher credit limit. This is not always a good thing, and you’ll need to consider whether you can afford it or not.

4. Minimum instalments

In your agreement, and once you’ve successfully opened the account you’ll see a minimum payment amount. This refers to the minimum amount you’ll need to pay each month toward your credit card balance, paying this amount means you will not incur extra fees or penalties above the interest rate you are paying on the balance. If you make more than one late payment on the minimum amount, you might in some cases see an impact on your credit score.

This minimum credit card payment amount is calculated as a percentage of your outstanding balance. In South Africa, minimum instalment interest rates can be anywhere from 2,5% to 12,5% of the outstanding balance each month. Because this amount can vary drastically between lenders it’s important to take note of each minimum instalment rate, especially if you have multiple credit cards with different minimum instalment rates.

Simply put, the lower your outstanding balance each month, the lower your minimum payment amount is.

5. Credit scores

As mentioned previously, your credit score plays a big part in the type of credit card and the interest rate you’ll be given access to. In the same breath, taking out a credit card is also an effective way of beginning your credit journey.

Applying for a low limit credit card can help you build a good credit score if you are able to keep up good spending habits by not spending more than your limit and repaying your balance on time.

However, the problem with a credit card is that often people can fall into the debt trap by maxing out their credit card with new limits offered by the bank. Don’t fall into this habit, where you only pay your minimum repayment each month, this can damage your financial health over time. One of the quickest ways to maintain a great credit score is to pay accounts and loans on time.

6. Credit card type

Whether you are going direct to the bank or using a comparison platform like Fincheck, it’s always a good idea to compare credit cards and weigh up your options. Finding a credit card type, with term agreements that suit your financial needs, is essential in maintaining your credit health.

Every bank offers different types of credit cards, each with its own set of requirements to get access to them. Standard credit cards, usually require a very low monthly income and will come with very few added benefits. A premium card will usually require a much higher monthly salary, and you’ll have additional perks including discounts on certain retailers, Airmiles, 24/7 customer service or points.

Comparison platforms like Fincheck, allow you to compare multiple offers from various banks based on your credit score and current monthly income.

Yes, added benefits may look like a “reward”, but most of the time it comes with a higher monthly credit card fee – so be aware of these costs.

7. Credit card fee & hidden costs rundown

A credit card is a complex financial tool, and there are often many hidden additional costs. One cost you can count on each month is a monthly service fee. If you are lucky enough, there are some credit cards in South Africa that don’t have a monthly service fee at all, but in most cases, you can’t avoid them.

Even if you have a current account open with a bank, there are still a number of fees you’ll be faced with, let’s run you through them all:

(P.S. don’t be afraid to ask banks to waive some of these fees if they can)

Initiation fee – this is a once-fee you’ll pay to the bank/lender to open the account (in some cases you can ask for this initiation fee to be waived)

Monthly account fee — this fee will be stipulated in your term agreement, and it will be added to your outstanding balance each month. *Some South African banks don’t charge a monthly fee.

Yearly fee – In most cases, you will not be charged a monthly fee in addition to a yearly fee. Your yearly fee is your total administration cost for the year. Certain banks will allow you to waive this fee completely, especially if you are shopping around for a credit card.

Withdrawal fees – withdrawals on your credit card should only happen in case of an emergency, as you’ll pay a pretty hefty price tag for withdrawing funds.

International transaction fees — most credit cards can be used overseas, and you’ll often need to tell your bank when you are travelling. However, in some cases, you can be faced with an international transaction fee.

Benefit fees – more premium credit cards often have a rewards programme that you can be part of, in some cases, this comes at an additional fee that’s hidden in your monthly credit card fee or yearly fee.

Credit life insurance – One cost that many people don’t realise is included in their monthly fee is credit life insurance. This is essentially an insurance amount you pay on any outstanding loan balance that covers the cost of your debt if something happens to you. What many people don’t realise, however, is you can change the provider being your bank to a dedicated credit life insurance provider! And usually, it saves a couple of bucks!

55-day interest-free period – even though you have a grace period before the interest kicks in when you spend money on your credit card, it is important to know that this doesn’t apply to when you transfer the money from your credit card to your current account for use.

8. Credit card benefits

There are a number of different credit card options available in South Africa, that come with exciting and attractive benefits. Depending on the type of account you have, you’ll be given access to various offers, the more premium the account the better the rewards. Let’s walk you through a couple of available credit card benefits:

- Free travel insurance

- Flight discounts

- Accommodation discounts

- Car rental discounts

- Air lounge access

- Points *which can be transferred into cash or used towards purchases

9. Can you afford a credit card?

Applying for a credit card can be exciting, especially when it opens up new spending opportunities. However, one of the most valuable questions you should ask yourself is,

- can I afford it now? And,

- can I still afford it later?

Most banks will only offer you a credit card if your credit score and monthly income allow you to take one out. Unfortunately, there are also cases where banks give credit cards to people with low affordability. With that being said, a huge part of it is still self-discipline. Will you be able to hold back on spending when other expenses pop up? Will you be able to stick to a budget even with a higher credit limit?

Holding the power of a credit card comes with many benefits and challenges, so it’s always a good idea to check in with yourself and see if you can still afford the credit card you have taken out.

For example, let’s say you’ve taken out a premium credit card which has a monthly fee of R300 a month and a credit limit of R500 000. If the monthly fee is too much, and the credit limit is too irresistible, it might be time to chat to your lender and “downsize”. According to Transunion, the average South African owes over R18 000 on their credit card, which highlights the value of getting your credit health back on track, and finding a credit card that you can afford.

10. Compare & apply

Shopping around for the best credit card is a no-brainer, whether you take it into your own hands, get help from a bank, or use a comparison platform like Fincheck.

Using all the pointers from above, you’ll be able to find a credit card that is best suited to your needs. If you use a comparison platform like Fincheck’s Credit Card page, it’s a great idea to get all the necessary documents in place so that you can have a smooth credit card application process and get approval in no time.

What documents will you need to apply for a credit card in South Africa?

- A certified copy of your ID/passport

- 3 months of verified bank statements

- 3 months’ payslips from the employer

- IF self-employed, a letter from your accountant stating your income

- Proof of residence not older than 3 months e.g. a lease or utility bill

Now that we’ve given you all the necessary tips and knowledge you’ll need to apply for a credit card, all that’s left now is to push the apply now button and get started on your credit journey.

Frequently Asked Questions about credit cards

Are credit cards safe in South Africa?

Yes, one of the selling points and draw cards for credit cards is their level of safety. The bank or lender will take all responsibility for fraudulent activity. Every bank has different credit card fraud policies, however, in most cases, they will refund the money back into your account after you have reported the fraudulent charge. It’s advised to contact your credit card company shortly after realising a fraudulent charge has come off your account. It’s common practice for a credit card company to notify you if they pick up fraudulent activity on your credit card, particularly if they are overseas transactions.

There is always the risk of having your card stolen, and thieves using your card at tap-to-pay merchants below the amount required to enter a pin. However, in most instances, your bank will refund this amount, if you report it as stolen immediately.

What credit score do I need to apply for a credit card?

A credit card is much like a loan in the sense that you are lending money from the bank or a lender and paying it back based on your repayment terms. In line with this, the credit score you need to apply for a credit card is much like any loan. The higher the credit score the more likely you’ll have a credit card approved. Credit scores needed for credit cards look roughly like this:

Below 500 – unlikely to get credit card approval

500 – 600 – likely to get credit card approval from selected banks and lenders

600 – 800 – highly likely to get credit card approval from most banks and lenders

(it’s important to note that these are not exact, and each bank varies with credit score requirements)

Why has my APR changed on my credit card?

It’s always important to read the terms of your credit card agreement with a magnifying glass. Often credit card companies will have promotional offers with a low APR to start off with, however further down the line, you are likely to have to pay a higher APR. Other contributing factors to a higher APR are changes in the economy or a very low credit score – if there is going to be a sudden change to your APR your bank is likely to notify you of these interest rate changes.

Should I use my debit card or credit card to purchase products online?

Credit cards and debit cards operate in the same way when it comes to making online purchases. Credit cards are more commonly used that debit cards for online purchases, because you are most likely able to earn rewards based on your transactions.

One of the most important reasons for making use of a credit card instead of a debit card is because of fraud. If someone makes a fraudulent charge on your credit card or fails to deliver a product or service you’ll be able to dispute and reverse the charge.

Off time isn’t always a good time when it comes to your pocket. With plenty of public holidays in April, overspending might negatively impact your credit health.

Enrol in our credit health course today and improve your credit score!