Did you know a bad vehicle finance agreement is one of the number 1 reasons people in South Africa have cash flow issues? If you think you know a thing or two about vehicle finance, chances are you could learn a whole lot more.

It’s important to understand everything you can about vehicle finance 🚗. An informed decision allows you to get access to the best vehicle finance interest rates and repayment periods. This means healthier cash flow and a better financial future!

Doing your homework means you’ll be able to easily buy a car within your budget, so we thought we’d help you with most of the legwork in our vehicle finance guide. Let’s get moving…

What is vehicle finance?

Vehicle finance is a type of secured loan specifically used for buying a car, either privately, or from a dealership. This type of finance is specifically structured for financing a car and therefore cannot be used for other types of purchases. Car loan products are mostly only available at banks or financial institutions that specifically list it as a product.

You will usually take out car finance when you do not want to take on a huge once-off expense of a car, but still want to be able to get from A to B in your own vehicle. Car loan monthly instalments make it possible for many South Africans to have a car without using all their precious savings that can rather go towards an asset like a home.

Need a quick and simple way to pay for a car? Then vehicle finance in South Africa is a great financial solution. Car loans usually have a lower interest rate compared to other personal loans and a much longer repayment period. It’s important to remember with car finance, that the financial institution will own the vehicle until you have paid your very last monthly instalment and any outstanding debt (like a balloon payment).

Did you know: Vehicle finance is a form of secured finance

What is a Secured Loan?

A secured loan has something of value as security for the loan. A home loan is a secured form of credit. The lender will take back the house if you fail to repay the home loan. A car loan is also a secured loan. Your lender will repossess (take back) the vehicle if you fail to make a payment.

But secured loans have an advantage. It usually has cheaper interest rates when compared to unsecured loans of the same amount. A car loan will have a cheaper interest rate when compared to a personal loan of the same amount. Cheaper interest rates lead to cheaper monthly repayments.

What are the different types of car finance?

Before taking out car finance, you need to know where you’d like to buy the car from. So there are namely 2 types of car finance:

Dealership finance

When you buy a vehicle from a dealership you will apply for this type of finance. It is structured to ensure you are protected with the correct finance for buying a vehicle from the dealership, new or used.

Private vehicle finance

Private vehicle finance options are specifically tailored for buying a vehicle from a private individual.

It’s important to remember that within these two types of finance different agreements will be made with the financial institution that is financing your vehicle. These agreements are usually in the form of the following:

- Instalment sale agreement

- Lease agreement

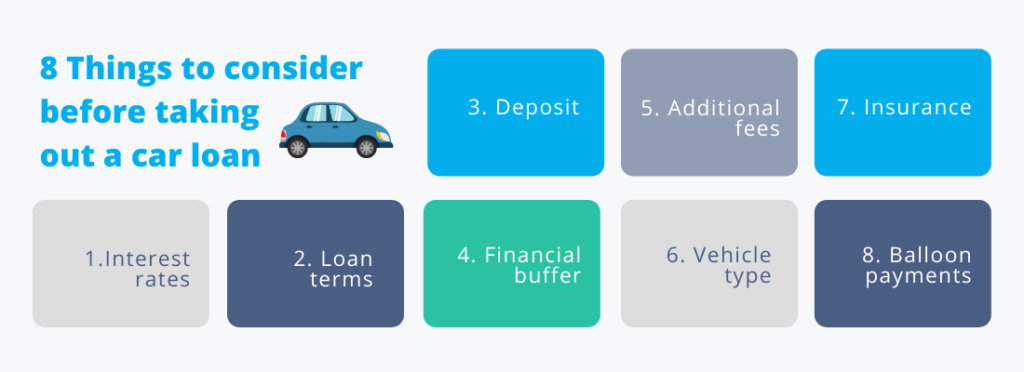

Later on, we will get to the 8 things you need to consider before taking out a loan, here is a sneak peek:

How do I qualify for car finance in South Africa and what do I need?

Please bear in mind these are general guidelines as to what a typical application for vehicle finance will require.

- Employed or self-employed

- 18 years or older

- Earn a salary that more than covers your monthly repayment and a healthy credit record

- Proof of income with payslips covering the 3 months prior to the application

- ID

- SA driver’s licence

- Residential proof

- Any applicable National Credit Act documents

Car finance 101: Understanding the basics of vehicle finance

Call it vehicle financing or a car loan. Essentially you’ll be taking out a loan to buy a car. Before we go any further, we want to make sure you understand all the basic building blocks of a car loan. Let’s go through the jargon in simple terms:

The Lender

This is the institution that offers to lend you money so that you can buy a car. Only borrow from an institution that is a registered credit and financial services provider. The National Credit Act protects the credit market in South Africa by regulating lenders with strict rules.

Car Loan Amount

A loan amount is also called a loan principal. This is the amount of credit you request from the lender. The loan amount on certain loans like a home loan can increase when you apply for more credit against your home. But a car loan has a fixed amount. You can’t increase it afterwards to borrow more money.

Admin and Initiation Fees

Most car loans have admin and initiation fees included. Either as a lump sum at the start, or as part of your monthly payment. Beware, unnecessary fees will make your loan expensive.

8 things to consider before taking out a car loan

1. Interest rates on car loans

Interest rates are one of the biggest influencers on repayment amounts when it comes to vehicle finance repayments. The better your credit record, the better interest rate you will be offered in most cases. The interest rate will most of the time be a certain percentage attached to the repo rate along with the deposit you put down, thus determining the affordability of your monthly repayment amount.

There are two types of interest rates that you will be able to choose from:

A variable interest rate option – will give you an interest rate attached to the repo rate and will change according to fluctuations in the repo rate.

A fixed interest rate option – might incur a higher interest rate offer because the bank creates a small buffer for itself if you have a fixed interest rate that will stay way below high changes in the repo rate.

2. Loan repayment terms or period of a car

The loan terms are the number of repayments you need to make. It’s calculated over a period of years. But that means you need to make a specific amount of monthly payments to repay the loan. You can either increase or decrease the loan terms. A shorter loan period leads to more expensive monthly payments (because you need to repay the loan in a shorter time). A longer loan period leads to cheaper monthly payments (because you have more time to repay the loan).

3. Deposit

Although it is considered an act of goodwill to put down a deposit for your vehicle finance application, there is no legally binding reason to do it, according to the National Credit Act. Apart from it being an act of goodwill, it is considered by most a wise financial move. Putting down at least a 10% deposit will dramatically influence your repayment amount. It is generally accepted, that the bigger the deposit of the total amount of the vehicle, the shorter your repayment term can be and the lower your repayment amount can be.

4. Financial buffer

As with any solid financial strategy, it is important to have a financial buffer in place above your disposable income for any types of loan repayments that will go off your accounts. Living on the edge and just making payments can be exhilarating for some, but a few defaults on your payments later will influence your credit score. A bad credit score means higher interest charges on future vehicle financing offers and payments that you find yourself in.

5. Additional Fees

Always make sure of the fees included in any transactions, contracts, or processes involved in buying the car and transferring the ownership to you.

6. Vehicle type

This might be more important for second-hand vehicles, but is also advisable for new vehicles, it is always a great idea to thoroughly check the vehicle you want to purchase. This means carefully combing through its interior, exterior and engine to ensure you have personal confirmation of its well standing.

7. Vehicle Insurance

No quality dealership will allow you to drive a new vehicle off its premises if you don’t have it covered on an insurance plan. As a dealership finance product, the dealership has taken a risk along with the bank or financial institution in financing the deal. This means that any risks that could influence the value or repayments of the vehicle need to be covered by a trustworthy insurance option.

8. Balloon payments or residual purchase agreements

You can choose to only finance a certain percentage of the total cost of the vehicle and pay the remainder on the final settlement date when the car loan repayment term ends. This percentage usually ranges between 15% – 35% and is usually influenced by the age of the vehicle as well. The balloon amount usually results in a big chunk of money you have to cover at the end or you will not get ownership of the car.

What are the pros and cons of vehicle finance?

A car loan is a form of a personal loan, but as the name states, it’s designed strictly for the purchase of a car. It’s secured against the car you want to purchase, so if you default on your payments, it’s goodbye shiny new wheels. A car loan has a fixed interest rate and thus fixed monthly repayments over the course of your repayment schedule. Also, the debt of a car loan is deemed as lower risk, thus resulting in a lower interest rate.

Here is a summary of the pros and cons of a car loan:

Pros:

- Usually a lower interest rate

- Easier to obtain

- Often a convenient ‘on the spot’ finance solution

Cons:

- You don’t have title to the car until the final repayment is made

- A deposit is generally required to secure the loan

5 tips to increase your chances of getting a Car Loan

We’ve taken you through everything you need to know about vehicle finance, but now it’s time to actually get to the groundwork and find ways of improving your chances of getting car finance in South Africa. We can’t promise that any of these tips are going to be quick fixes, but they are definitely a push in the right direction to improve your chances. Here are a few things you can do:

1. Improve Your Income

Steady sources of income help to secure loans, in addition to that increasing the amount of money you bring each month can also assist with getting the car you really want and bring down the interest rate. Whether it’s a side hustle or gunning for a promotion at work, either way increasing your monthly income is a big help with getting access to a car loan. When you buy a car, make sure you have proof of income so the dealer can negotiate deals with the bank.

2. Build a healthy Credit Score

This is a pretty important step in improving your chances of getting vehicle finance. Your credit score is a reflection of your spending habits and credit history, so the healthier it is the better for a lender. Follow our step-by-step guide to get your credit health back on track, so that you can get access to car finance quicker. Alternatively, if you require major improvements on your credit score, enrol in our insightful credit health course.

3. Increase the Loan Terms/Period

You will have to repay more over the lifetime of the loan, but it will lower your monthly payment. A lower monthly payment could help to fit your budget and convince the lender about your ability to repay the loan if your salary is not high enough currently.

4. Consider a Balloon Payment

It’s risky because without discipline it almost always leads to landing in a debt cycle, but it can be helpful to get you going if you urgently need a car. Especially if you plan on earning significantly more at a later stage, or plan on selling your home to downsize. Paying off a large sum at the end of a loan is a helpful way to get access to a car now, which you can pay in full later, but you should probably consider getting a cheaper or smaller car.

5. Only Buy The Car You Need

You don’t need a sports car, so rather don’t bother looking at one. A trap that a lot of South Africans fall into when financing a car is test driving cars they can’t afford – donnnn’t do it! Stick to your budget and always remember why you needed the car. Buying what you need also helps to lower the total amount you request. A lower loan amount increases your chances of success. Plus it’s cheaper to repay.

Which is the best vehicle finance in South Africa?

We could run you through them all, but we’ve decided to do a bit of the legwork for you. Fincheck allows you to compare vehicle loan offers so that you are matched with the right lender to suit your financial needs.

So now it’s up to you to decide.

This is probably the biggest financial step you’ll take after buying your first home, and although we want to make sure it’s still an exciting adventure there are lots of things you need to consider before taking the leap.

Now that you’ve weighed up the pros and cons and followed the helpful tips to improve your chances of getting a car loan, all that’s left now is to apply for car financing.

Frequently asked questions about car finance

What’s the difference between car finance and vehicle refinancing?

This may be a confusing one, but these are completely different types of financing. Car finance is a loan you take out from a lender to finance a car specifically, vehicle refinancing is using your car (which is paid in full) as leverage to take out a loan. The main difference between the two is ownership, car financing you don’t yet own the car and with vehicle financing, you already own the car and are using it as collateral against the loan.

What’s the difference between capital balance and contract balance?

The capital balance is the amount you borrowed but it excludes the future interest rate you will pay in monthly instalments. It is the amount you will have to pay if you want to settle the contract. The contract balance is the amount you borrowed plus all the interest calculated onto that amount and it is what you will pay in total for the vehicle if you finance it for the full term.

Can I use a personal loan to buy a car?

This is a common question among potential car buyers, so we are going to run you through whether you can take out a personal loan to buy a car in South Africa.

In short, the answer is yes you can. So let’s take a deeper look at using a Personal Loan to finance a car:

You can use a personal loan for almost any purpose. Whether you need to cover medical costs, unforeseen bills, improve your home, or in this case, purchase a car. Personal loans are usually the cheapest way of financing a car deal, provided you have a good credit rating. Always look at your APR (annual percentage rate) to know what exactly you’ll pay as it factors in all fees and other costs associated with the loan. You can apply for a secured (provide collateral as security) or an unsecured personal loan. If you have great confidence in your ability to make the repayment, you can consider a secured loan as this can get a lower interest rate. Though, if you’re not so comfortable with the thought of leveraging against the roof over your head, apply for an unsecured personal loan.

To sum up a personal loan:

Pros:

- No restrictions on how funds are spent

- Flexibility in payment structure

Cons:

- Interest rates are a bit higher

- Strict lending requirements

- Consumers with lower credit scores won’t qualify as easily

Will you need vehicle insurance when you are financing a car?

South Africa does not have legislation requiring car owners to take out insurance. Therefore, it is not compulsory for people who buy their cars in cash. It is, however, compulsory if you are financing your car. The financial institution that finances your vehicle will either insure the car themselves (at your expense) or require proof of insurance.

Even though the monthly premium could be a burden at times and you would want to spend the money elsewhere, there is always a risk that your car could be damaged, stolen or hijacked or damaged by a third party. If this happens and you do not have car insurance, you will be liable to cover all the costs from your own pocket. These costs are usually large and can be financially devastating. Therefore, it is a wise choice to choose the right insurance that fits into your monthly budget but also covers you for all unforeseen events.

What credit score is needed for car finance in South Africa?

If you are stressing about your credit score and whether it’s high enough to take out a car loan, chances are you need to improve it to some measure. Like most loans, the lower the score the lower your chances of getting improved.

Credit scores are loosely viewed like this by creditors:

800+ – Exceptional

740 to 799 – Excellent

670 to 739 – Very Good

580 to 669 – Good

579 & below – Poor

A credit score above 580 means you will be considered for a car loan. With a score above 670, the vehicle finance lender will consider you a very good borrower and you’ll be seen as less likely to default on your car payments.

What is rent to own and how does it differ to vehicle finance?

A rent to own or rent to buy agreement is very simply just renting a vehicle on a monthly basis per agreed upon contract. This is instead of financing it through a financier.

In this agreement, you will usually pay an agreed minimum deposit or percentage of the car’s value. This will be followed by fixed monthly finance instalments (or rent) which effectively results in hiring the vehicle until the final amount has been paid. There is no interest applicable, and these companies usually only cover lower-end vehicles due to the risky nature of the business.

At the end of the period, you can purchase the car, or you can also get your car sooner by requesting a settlement amount.

The difference between rent to own and vehicle finance is that with rent to own, you are not required to have a good credit history or collateral. You can also return the item at any time without penalty. With vehicle finance, you are locked into a financing agreement, where you need to pay back the car loan over a set amount of time, the intention is that when you finish paying off the loan, you’ll be able to own it in full.

What is the best car finance in South Africa?

This is not a simple answer. Especially when it comes to the number of car finance providers available in South Africa. We like to remain unbiased at Fincheck, so instead, we are going to give you the rundown of the 5 best car loan lenders in South Africa, both traditional and alternative lenders. Read more in our vehicle finance review.