Finding the right credit card in South Africa that ticks all the boxes can be quite a challenge, especially if you have no clue where to start. Whether it’s your first time applying for a credit card or you are looking to swap over to something better suited to your needs – everyone can do with a little help to guide them along the way. We’ve decided to do the groundwork for you by researching which are the best, easiest and most affordable credit cards available in South Africa right now.

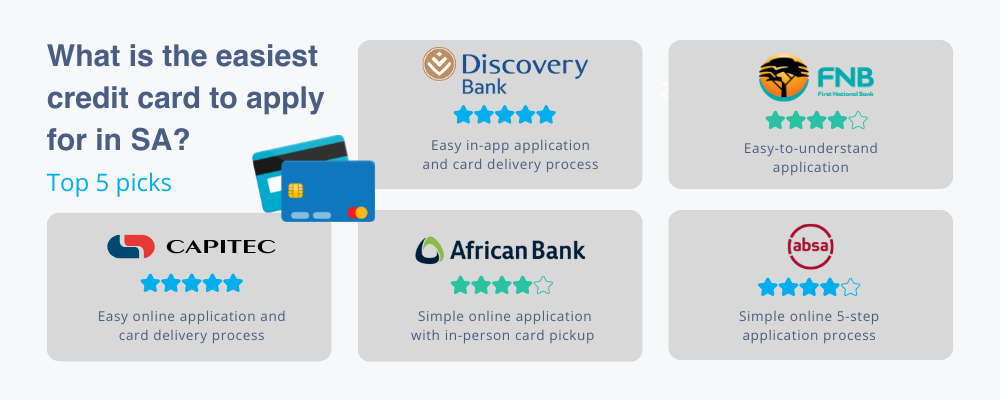

5 easiest credit cards to get in South Africa

1. Capitec GlobalOne Credit Card

Application process:

To start the application you’ll need to either head to a branch, the Capitec website or use the mobile app. It’s a very sleek and simple process. First, you’ll need to fill in all your personal details as well as how much credit you are looking for. You’ll also need to give your employer’s details, as well as your salary after deductions. Once you have verified your details and uploaded the necessary documents you’ll be given a live result on whether your application was successful or not. If your application was successful you can choose whether to fetch the card at your nearest branch or have it delivered to your door.

Requirements & fees:

- Original ID document (must be 18 years or older)

- Latest salary slip

- 3-month bank statement

- The minimum salary requirement for a Capitec GlobalOne Credit Card application is R5 000 and R10 000 for self-employed clients

- R45 monthly management fee

Benefits:

- A credit limit of up to R500 000

- Interest from prime

- Free credit card delivery to your door

- 1% cash back when you click, tap, swipe or scan to pay in-store or online

- Free travel insurance up to R5 million

- Free local swipes

- Up to 55 days interest-free period

Ease of application:

5/5

2. Discovery Bank Gold Credit Card

Application process:

If you are new to Discovery Bank, you’ll need to register and find the account that’s best suited to your needs. To ensure you find the ideal bank account, you’ll be asked 3 questions regarding what you are looking for. These questions will be about: your financial information, about you and your product. First, you’ll be asked what your salary is before tax, what your financial situation is currently and then what financial product you are looking for e.g. credit card. After this, you’ll enter your personal details (they do not need to be verified) and then you’ll be given a number of options. If you are not looking for a suite (a bundle of a transactional account and a credit card), then just select the credit card you’d like to apply for. You’ll need to download the app on your phone to start the credit card application process. On the app, you’ll need to follow the prompted steps. Enter all your personal details and financial information, and then upload the documents straight onto the app. Once your application is successful, your credit card will be delivered in 3-5 working days. To activate your card you’ll need to use it to make a transaction. After activation you’ll have access to both your virtual card and physical Discovery Bank Gold Credit Card.

Requirements & fees:

- Original ID document (must be 18 years or older)

- A minimum salary of R11 500 a month or an annual income of up to R350 000

- Latest salary slip or 3-month bank statement

- R80 monthly management fee

- R65 withdrawal on international ATMs

Benefits:

- Up to 55 days interest-free for selected credit card transactions

- The flexible credit facility on the market

- Vitality Money, which rewards you for banking healthier with Dynamic Interest Rates and boosted Vitality rewards

- Earn 1 Discovery Mile for every R20 spent on your Discovery Bank Gold credit card

- Get enhanced payment features including tap and go, Fitbit Pay, Garmin Pay and Samsung Pay

Ease of application:

5/5

3. African Bank Black Credit Card

Application process:

The first step in applying for an African Bank Black Credit Card online is to register via their website. The process is only 4 steps long. First, you’ll be required to enter all your personal information and verify your phone number via a prompt on your phone. If you are new to African bank there will be a few extra steps involved. You’ll need to verify your identity via a selfie, and following that you’ll need to upload all the required documents. The application process takes roughly 10 minutes from beginning to end if you have all the correct documentation. Once your application is successful African Bank will send you an SMS or email notifying you. After this, you’ll need to visit your nearest African Bank branch to get a printed embossed Credit card. To activate your card, you can either visit a branch, go online or log in to your African Bank App. Just remember that when visiting a branch you’ll need to bring along your South African Identity Document to confirm your details. Once the card is activated you’ll be notified via SMS, and can start swiping.

Requirements & fees:

- You’ll need to provide proof of residence e.g. a bill, it cannot be older than three months

- Provide your latest bank statement with the last three salary deposits

- Provide the last three payslips

- R50 monthly management fee

Benefits:

- 62-day interest-free credit on all transactions that are made before the required due date

- No charges in any store in South Africa

- Covered with the African Bank Life Insurance

- Emergency services

- Medical and Legal referral

- 3% interest back

- You’ll be able to make withdrawals of R4 – 10k from any ATM

- Free travel assistance whenever you make international travels

*Bonus – for more tips on how to get the most out of your credit card read their beginners guide.

Ease of application:

4/5

*only because you need to visit a branch to collect your credit card

4. Absa Flexi Core Credit Card

Application process:

To get started on your Absa Flexi Core Credit Card you’ll need to either head to the website or your nearest branch. The application is a 5-step process, and although it’s quite lengthy is very straightforward and will mean you won’t need to submit further documentation at a larger stage. The first step is collecting all your personal information as well as uploading your ID document. Then you’ll need to fill in all your financial information as well as upload your payslips and bank statements. After that, you’ll need to fill in a few more personal details and then you’ll be given options on the card that you can choose. In this case, you’ll select Absa Flexi Core Credit Card. Once you’ve selected the card you’ll need to set up your card and choose whether you’d like it delivered or if you’ll fetch it from your nearest branch.

Side note: For the younger generations, a more affordable credit card option is the Absa Student Credit Card. This offers South African students the ability to access credit without transaction or monthly fees. The only requirement is that the cardholder has a monthly ‘allowance’ of R800. Absa’s aim is to encourage building a positive credit history among younger generations.

Requirements & fees:

- Minimum monthly salary of R2000

- Original ID document (must be 18 years and older)

- Subject to an affordability assessment

- Transaction fee: No transaction fees on purchases

- R44 monthly management fee

- R75 overseas cash withdrawals

Benefits:

- Travel insurance: Automatic basic cover* for a range of travel emergencies

- Absa Rewards: Get cash back when you pay with your card locally and internationally

- Absa Advantage: Complete simple challenges on the Absa Banking App and get rewarded instantly for banking smarter

- Exclusive Visa benefits such as Visa Global Merchant offers

- Contactless payments: Tap to pay with your card, smartphone or wearable device at any point-of-sale machine worldwide

- NotifyMe: For added security, activate SMS notifications to get alerts of any activity in your account

- With your credit card, you can get up to 57 days interest-free on purchases.

Ease of application:

4/5

*although the application process was easy to understand it was quite lengthy.

5. FNB Aspire credit card

Application process:

To get started with the FNB credit card application if you are a new customer, you’ll need to either go to their website, visit the nearest branch or download their app. Fo ran online application, you’ll need to build your profile with all your personal details, and then you’ll need to set up your digital banking. There are quite a few steps involved with giving consent to the credit card application, and you’ll need to verify your affordability assessment. A nice addition at this step is that you can opt out of any and all marketing communications. You’ll be able to upload all the necessary supporting documents via the application portal. Once your FNB Aspire Credit Card application has been successful, FNB will courier the card straight to your door (or if you’d like you can fetch it in person).

Requirements & fees:

- You need to earn between R84 000 – R449 999 per year

- Copy of your recent pay slip

- Three months’ bank statements

- South African ID book/card

- Proof of residence

- R42 monthly management fee

- R75 overseas cash withdrawals

- R80 overseas cash withdrawals + R2,85 per R100

Benefits:

- Unlimited card swipes

- Personalised and competitive interest rates based on your personal risk profile

- Earn eBucks rewards on your credit card purchases at Checkers, Clicks, Engen and InterCape

- Access to a budget facility with repayment periods from 6 – 60 months for purchases over R200 or more

- The ability to move unexpected medical expenses to budget at an interest rate of prime or prime +2%*

- Free Global Travel Insurance cover for the first 90 days of your journey, only when you use your qualifying FNB Credit Card to purchase your international return travel ticket(s)

- Earn 2 complimentary SLOW lounge visits per annum when booking your flights through eBucks

Ease of application:

4/5

*Although the application was easy to understand, you do need to verify your consent quite often which could make it a bit daunting for first-time credit card applicants.

Credit card providers who miss the mark:

Although there are a number of financial institutions and lenders who promise easy credit card applications and approvals there are still a few that miss the mark.

*Full disclosure this process may vary from consumer to consumer, this was just based on the experiences of those interviewed for this post.

Woolworths Credit Card

Insights from Nikolaos Spyratos, Senior Engineer at Finch Technologies

The application process:

The Woolworth Credit Card online application is pretty painless and has a nicely designed flow. The application form has 9 steps, where you’ll be asked for your name, number, email, ID and income. The ID verification is a bit slow where you need to take two photos, along with uploading your ID documents. Following that, you need to upload your payslips or a bank statement. After completing this step applicants will likely receive an SMS or email, asking for further documentation. If necessary one of their team members will call you to verify these documents. After document verification, you’ll receive an email stating if your application has been approved or not. The application, approval and card delivery process could take anywhere between 5-7 working days and to collect your credit card you’ll need to show your original ID document (not your driver’s license) and proof of address no older than 3 months old.

The requirements & fees for a Woolworths Gold Credit Card:

- R53 monthly management fee

- R60 overseas cash withdrawals

- A valid South African ID document (18 years and older)

- Earn in excess of R3000 a month

- A copy of your latest payslip or bank statement

- A copy of your original bank statement or utility bill (cannot be Absa or Woolies statements)

The benefits of a Woolworths Gold Credit Card:

- Get rewarded on Woolworth’s purchases with exclusive offers

- 2% back in quarterly vouchers on all your Woolworth’s purchases

- Free additional cards

- Free travel insurance

Ease of application:

2.5/5

*The online application was simple and easy to navigate. However, after submitting the application, the verification process is very manual and you’ll need to visit a store to collect your credit card and further verify your ID and proof of address with physical documents.

Standard Bank Gold Credit Card

Insights from Ashleigh Butterworth, Content Marketing Specialist at Finch Technologies

Application process:

To apply for a Standard Bank Gold Credit Card online, the first step is to check whether you qualify or not. Then you’ll be taken to another window where you’ll need to select what type of credit you’d like. If you do not have a Standard Bank transactional account/or do not have online banking you’ll need to register first. The Standard Bank Credit Card application process is 3 steps long, and it’s pretty straightforward. You’ll need to submit your personal details, as well as your gross salary. After that, you’ll be required to submit your employer details as well as your last 3 months’ bank statements and a payslip. After this step, you’ll be told whether the bank requires more documents or if your application was successful. If further documentation is required the bank might request to contact your employer and ask for a letter of employment. The step of requiring further documentation and the need thereafter to verify the documents takes a bit of time. After a few days, you’ll be notified over email whether your application was successful. Your card will either be delivered to your doorstep or you can fetch it from a branch.

Requirements & fees:

- South African ID copy (or passport if not an SA citizen)*

- A recent payslip and 3 months bank statement

- Proof of residence not older than 3 months

- Must earn R5 000 or more per month R60 monthly fee

- R180 initiation fee

Benefits:

- 0%* interest rate when you choose the 6-month budget plan to pay for your in-store or online purchases

- Get up to 55 days free interest if your account is paid in full

- 3% minimum monthly repayment with an automatic payment option

- Travel benefits with discounts on flights and accommodation

- Lifestyle benefits – with UCount Rewards & discounts off Wine Club

- Basic travel insurance

Ease of application:

3/5

*Although the online application was simple, the rest of the application and document verification took too long. The process of a bank employee having to make contact with you rather than it being instant approval was unnecessary.

How can I compare credit card offers?

If you are struggling with comparing credit cards in South Africa an easy solution is to use Fincheck. In 3 quick steps you’ll be able to compare offers from reputable credit card providers and make the best decision based on your financial needs.

How can you improve your credit health?

A bad credit score can affect whether you can get approval for a credit card or not. We’d suggest enrolling in the Credit Health Course from Fincheck Academy so that you can better your financial well-being and your credit score.