We all want to be driving off the showroom floor in a set of shiny new wheels, but the reality is you’ll first need to check what’s in your pocket before making this huge financial decision.

Buying a new car should be a fun experience, you get to decide on the colour, make and model – but often vehicle buyers can fall into the trap of spending more than they hoped. It’s pretty a simple question, with an often complicated answer, so we want to make it as simple as possible so you can make a decision you are happy with. So what car can you afford on your salary? Let’s walk you through everything you need to know about car affordability in South Africa so you can make a decision you are happy with.

How much should you spend on a car?

The golden rule when buying a car with cash in South Africa is that the price should never exceed 30% of your gross annual salary, even if it’s the car of your dreams. Let’s say you don’t need the fanciest and shiniest car, and all you need is a ride to get you from A to B, then you should be capping your price at 20-15% of your annual salary.

If we look at the latest Quarterly Employment Statistics from Statistics SA, the average South African salary in February 2021 was earning R23 122. Once you’ve taken off tax, this earner is left with around R19 864 per month.

See the example below for:

A breakdown of what the average earner in South Africa can afford to pay for a car:

R23 111 x 12 (months) = R277332 (gross annual salary)

R277 332 x 0,3 (30%) = R83 199

So the average earner should not be spending more than R83 119 on purchasing a new car.

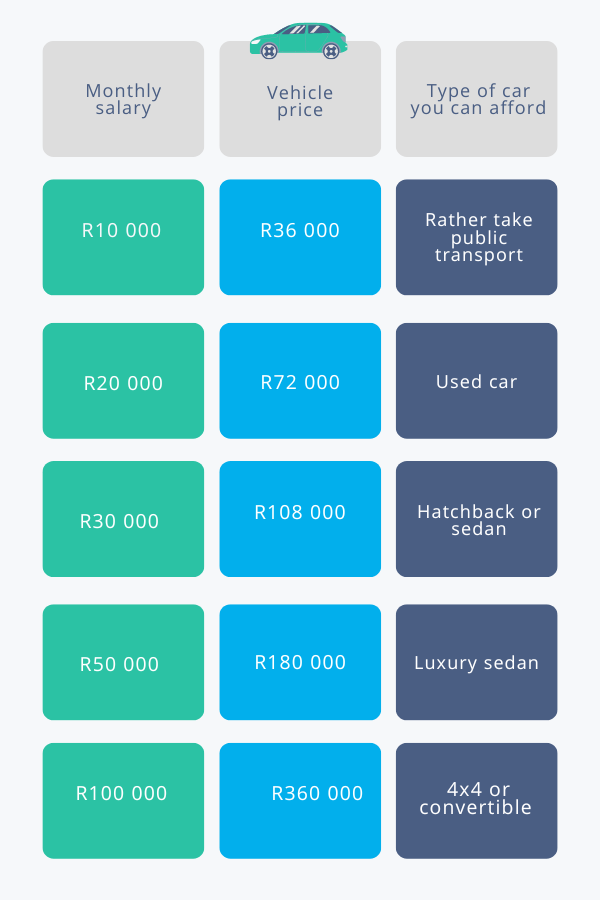

Breakdown of what type car you can afford based on your salary:

What can you afford to spend on vehicle finance?

If you’d like to take out vehicle finance to buy a car, then you’ll need to look at what you can afford. The rule of thumb is slightly different in South Africa when it comes to vehicle finance, according to Top Auto South Africa car buyers should not be spending more than 20% of their monthly salary on vehicle finance payments.

See the example below for:

A breakdown of what the average earner in South Africa can afford to pay for vehicle finance payments:

R23 111 x 0,2 (20%) = R4622

So an average earner in South Africa should not be paying more than R4622 a month for vehicle finance.

Obviously, this calculation has not taken into consideration other monthly expenses like car insurance, home loans, and fuel, which are all crucial when deciding how much you can afford to pay.

How much should you spend on your vehicle finance payments?

Using the ‘20% rule’ for vehicle finance, we’ve broken down how much you should be spending based on your monthly gross salary, including the vehicle price that you should be looking at.

| Salary | Monthly Instalments | Vehicle price |

| R10 000 | R2000 | >R100 000 |

| R20 000 | R4000 | >R200 000 |

| R30 000 | R6000 | >R300 000 |

| R50 000 | R10 000 | >R500 000 |

| R70 000 | R14 000 | >R750 000 |

| R100 000 | R20 000 | >R1000 000 |

The above information is by no means financial advice, this is a rough example of what salary earners should be paying on vehicle finance every month. Business Tech has also outlined what South Africans can afford to pay for vehicle finance based on annual interest rate of 9% over five years.

What are all the costs you should consider before buying a car?

Purchase Price

This is the number one most important cost to consider as it determines all the other costs involved when purchasing a car. If you choose to purchase an expensive car you’ll be spending more on vehicle finance, car insurance and running costs.

Vehicle finance deposit

Although not mandatory when taking out vehicle finance, it’s a smart move if you have the cash right now. A down payment on a car, means you’ll monthly instalments will be lowered.

Vehicle finance interest rate

The interest rate you pay on your vehicle will determine what you can afford or not, the higher the interest rate the higher the monthly payment.

Vehicle Finance

The cost of your monthly vehicle finance payment is determined by the interest rate and the length of the financing term.

Vehicle Insurance

Depending on the car you choose to purchase, your vehicle insurance cost will be determined based on your credit score, your driver risk profile and the purchase price of the car.

Car service & maintenance

Often forgotten when purchasing a car is the cost of servicing and maintaining your car. If you buy a more expensive car you are looking at costly car services and repairs.

Fuel price

This one is a biggie in South Africa. The cost of fuel prices (and the fluctacting price), should be factored in when purchasing a car. You also need to think about the distance you are regularly going to be driving in the car.

Vehicle Depreciation

The moment you drive it off the showroom flow your car loses value. Make sure you do your research and look at what the depreciation rate is for different cars.

How do I apply for vehicle finance?

Vehicle finance or a car loan is specifically tailored for individuals who cannot or do not want to take on the huge once-off expense of a car. Finding the right vehicle finance provider can be tough stuff, so we’ve made it a whole lot easier for South African consumers. Compare offers in less than 2 minutes, and get the vehicle finance you need.

Who is the best vehicle finance provider?

With so many car loan options to choose from you might find it tough to decide. But when the time comes to purchase a new car, buying the car you want with the best car finance provider can make all the difference in the world. In our blog post, we will walk you through the best traditional banks & lenders and alternative lenders providing car financing in South Africa.

Our top 5 vehicle finance providers in South Africa:

What things should I keep in mind when buying a new car?

Buying a new car can be a very exciting but tedious task with so many options and factors to consider it can become quite difficult to navigate the car-buying journey. In our blog post, we unpack the 10 things you’ll need to keep in mind when buying a new car.

If you need any more assistance during your car buying and vehicle finance journey, be sure to read our full guide on understanding vehicle finance in South Africa.